Why You’ll In all probability By no means Run Out Of Cash – Cyber Tech

As unusual as it could sound, incomes monetary freedom is quite a bit simpler for sure individuals than claiming that freedom as soon as they’ve earned it. And if the next assertion rings true to you, chances are you’ll be affected by this similar hardship:

“I feel I’m near having sufficient cash to leap into early retirement, however not fairly.

So I’m simply working another 12 months and beginning another aspect hustle and buckling down additional onerous to be extra sure.”

It sounds rational, proper? In any case, you may by no means be too cautious, because the saying goes.

However the issue is that these individuals preserve repeating the mantra no matter how a lot cash they’ve, and no matter their precise dwelling bills. Regardless of how vivid their monetary image is, they all the time discover a strategy to undervalue their financial savings and overestimate their future bills, simply in case of the sudden.

And by tilting the steadiness ever additional within the route of “security”, they overlook about what needs to be on the opposite aspect of the size, which is “taking advantage of your finite time on this pretty planet.”

This occurs far more than you may suppose. Each week, it’s in my e mail inbox and my in-person conversations with individuals I meet. This worry is even prevalent amongst a few of my real-life mates, so let’s take a look at a few thinly disguised examples from that group to see among the signs (and a attainable remedy for) this famed affliction of One Extra 12 months Syndrome.

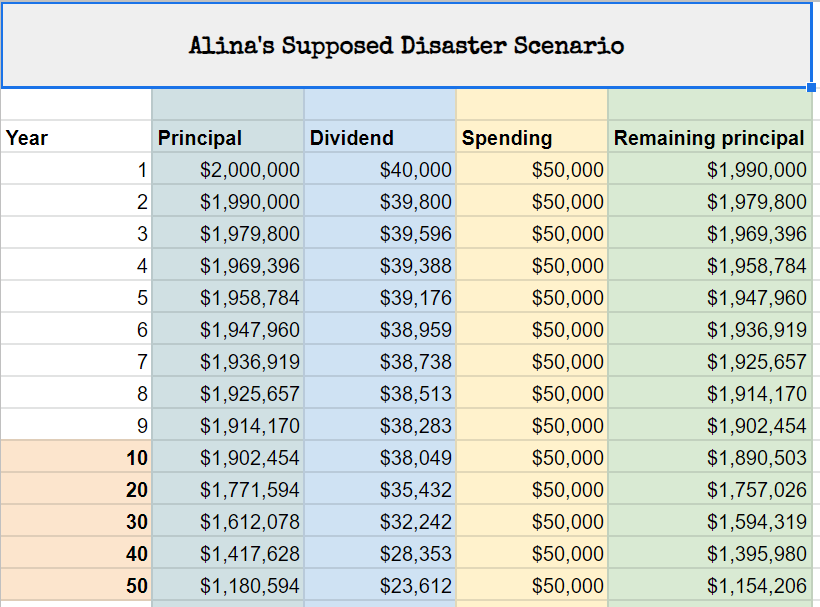

Alina’s Anemic Withdrawal Fee

Alina is a currently-single physician in a hectic however nicely paid space of observe, age 50 with one grown little one. She has about $2 million in investments, and at present spends about $50,000 per 12 months, a degree which incorporates just about all the pieces that’s necessary to her.

In line with The 4% Rule, Alina’s nest egg will present a reasonably dependable earnings of roughly $80,000 per 12 months for the remainder of her life. Or to place it one other manner, her deliberate spending of $50k is just a 2.5% withdrawal fee from that 2 million. Since 4% within reason secure, 2.5% is a preposterously secure withdrawal fee.

However wait! There’s extra. Within the curiosity of being conservative, Alina has intentionally ignored a number of different key items of her personal monetary future:

- All future social safety earnings (over $2000 monthly for the final 2-3 many years of your life)

- A extremely doubtless inheritance from her mother and father who, whereas clever and vibrant and nonetheless doing nice, are of their early 80s.

- And she or he’s additionally assuming that she is going to by no means couple up with one other associate sometime and share family bills, even supposing she’s a pretty and sociable particular person with many choices on this division.

Her response to this sense of additional warning? Simply crank it out for an additional 12 months or three within the furnace of the working room, and maintain off on any luxuries to avoid wasting up one other few hundred thousand, simply in case.

Dave’s Deceptively Brilliant Future

My different pal Dave is ten years youthful, with a decrease earnings however equally scrappy and really entrepreneurial. He has been a star performer in a really underpaid full-time job for over fifteen years. His whole annual spending – together with a mortgage on a $430,000 home right here in Longmont – is just about $45,000 per 12 months.

Though Dave lives in high-cost Colorado, he has fastidiously amassed eight rental residences again in his hometown (a midsized metropolis in Ohio), which very conservatively ship $2800 monthly of internet cashflow, whereas additionally growing his wealth by an additional $3000 each month via principal payoff and appreciation.

He additionally has a few aspect jobs, serving to varied members of our native HQ Coworking area with their companies, which usher in an additional $1000 monthly.

After which the kicker: Over the previous seven months, Dave and I teamed as much as renovate the principle flooring of that considerably expensive new home into a really high-end Airbnb rental. We lately pressed the button to make this place go stay, and it grew to become an instantaneous success with nearly no emptiness, now bringing in one other $5000 monthly (!?), whereas nonetheless leaving him together with his completed walkout lower-level house as a spot to stay.

So, Dave resides in his personal basement gathering $5000 each month, whereas spending solely $2000 on the mortgage. In different phrases, he’s dwelling without cost and getting paid a further $3000 for the chore of proudly owning this home, a trick formally generally known as the “Mustachian Inversion”

For those who add all this up, he has a complete enterprise earnings of $8800 monthly ($105,600 per 12 months!), which completely dwarfs his $45,000 spending even with out bearing in mind the wage from that crappy full-time job which he has been desirous to give up for thus lengthy.

While you add within the extra $3000 monthly of mortgage principal payoff and appreciation of the leases, my pal’s aspect hustles are netting him $140,000 yearly. And his financial institution accounts mirror this: there are sizable money reserves and upkeep and contingency funds for each rental unit, plus a well-funded private 401k plan and each different little bit of accountable monetary preparation you may think about.

Chances are you’ll be barely jealous of Dave as a result of he’s all set to relax and benefit from the proceeds of all this difficult work for all times. He may reduce his earnings in half and his wealth would nonetheless improve quickly without end.

However bear in mind, on high of all this he nonetheless has that full time job which is demanding about 10 hours of his time every single day, with a number of hours of Zoom conferences packed in all through, eliminating the potential of slacking.

Dave is a good sport and places on a courageous face, however all of us within the native mates group can inform that he’s almost buckling underneath the stress of this shitty, hectic job, particularly mixed together with his overflowing salad bowl of aspect hustles.

“Dave, you cussed dumbass, it is advisable to give up that job yesterday”,

is the loving message we now have been attempting to get into his head.

“Yeah, I do know”, he says, “However I’m simply holding on for another 12 months, simply to pad the accounts a bit additional. What if the Airbnb slows down? What if my rental homes expertise some emptiness? What if I wish to assist my nephew with faculty ten years down the road?”

Alina and Dave are each leaning upon the outdated rule of “You possibly can by no means be too secure”, and many individuals agree with that assertion, as a result of how may you argue with such plain folksy knowledge?

However this rule is inaccurate. It’s certainly attainable to be “too secure”, as a result of security comes at a excessive price – and the value is your personal life.

If Dave enjoys excellent well being and lives to age 90, he nonetheless solely has about 600 months left to stay, or an much more valuable 240 months of “youth” earlier than hitting age 60. And Alina’s remaining 120 months of youth are much more pricey.

With each of their monetary conditions already so soft, why oh why are my pricey mates buying and selling away this time for jobs they don’t get pleasure from, simply to get that final shred of pointless security?

Why are they letting these jobs compromise their friendships and relationships, price them sleep, miss out on tenting journeys and worldwide adventures and simply plain lazy Tuesday brunches with the individuals they love essentially the most? (most of whom are already retired and at present having brunch with out them?)

The true reply in fact isn’t cash, it’s worry.

However in case you dig deeper, their worry continues to be about “operating out of cash”, although it’s nearly mathematically not possible at this level.

To coach away this worry in myself and others, I wish to conduct a thought experiment. And that’s to drive your self via the numbers (utilizing a spreadsheet) of those two issues.

- For those who give up your job proper now, what would , typical, and improbably unhealthy state of affairs appear like to your monetary future?

- Then within the case of the “unhealthy” state of affairs, write down, step-by-step, what it will actually imply so that you can run out of cash.

This generally is a loopy thought experiment, however in lots of circumstances it would additionally reveal simply how a lot of a ridiculously lucky fortress you may have constructed for your self.

As a result of in contrast to you, most individuals within the US actually are nearly out of cash. They’ve nearly no retirement financial savings, month-to-month spending that meets or exceeds their earnings, and an array of automobile loans, scholar loans, and bank card debt that grows yearly. A full ten p.c of households have a destructive internet value, and even the median internet value is underneath $100,000 which means half of us have solely a 1-2 12 months cushion between ourselves and being useless broke.

If the common particular person quits their job, any shreds of internet value could be depleted nearly instantly. At this level, the owner and the gathering businesses come calling, and they’d actually find yourself with no meals or shelter past what is out there via welfare packages. It’s a tough place to be, however this class consists of tens of thousands and thousands of individuals within the US.

However for many Mustachians contemplating early retirement, the scenario is totally totally different. And to show this level, let’s attempt to get Alina to go bankrupt.

(notice: I made the entire spreadsheets and graphs beneath in “actual” (inflation-adjusted) {dollars} in order that they make extra sense from our perspective of at this time. In actuality, all of the numbers (each spending and investments/earnings) will get larger over time relying on the speed of inflation, however the internet impact is similar)

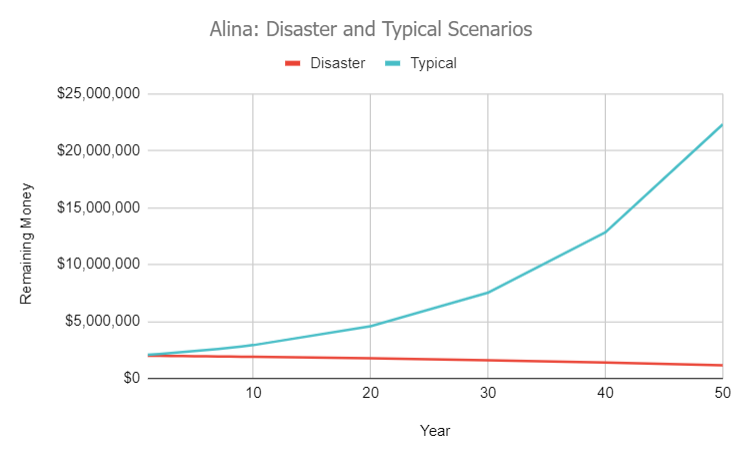

Alina: The Worst Case Situation

As an alternative of “another 12 months”, she quits her job now.

Despite the fact that the inventory market tends to develop together with the economic system, let’s assume we enter a by no means ending interval of stagnation the place shares barely even match inflation, and he or she decides to stay solely off of the dividends of her $2 million portfolio, that are a paltry 2% in the meanwhile, or $40,000 per 12 months.

However regardless of her conservative funding administration, she insists on conserving her spending on the full $50k. She by no means rents out an house in her home, by no means finds any pastimes that generate any earnings, by no means switches from Entire Meals to Costco, retains up the worldwide journey, and all the time retains a new-ish automobile within the driveway even supposing she has no extra commute.

The US Social Safety program one way or the other will get canceled even supposing our growing older inhabitants carries the majority of the voting energy and would by no means vote away its personal retirement earnings, and her mother and pa resolve to donate all their remaining wealth to charity somewhat than leaving it to Alina and her sister.

Within the occasion of this ridiculously contrived instance, she would find yourself drawing down $10,000 per 12 months from her financial savings, which implies her wealth would drain all the way down to, uh-oh, 1.99 million after the primary 12 months. And the development would proceed like this:

Uh-oh. So the worst issues have occurred in lots of areas of her financial life, and Alina lives out the subsequent 40 years of her life and dies with solely $1,395,000 within the account. What a harrowing shut name!

However what if issues turned out worse than the worst? Regardless of our greatest efforts to make her go bankrupt, she nonetheless died a millionaire. So we have to get slightly extra Mad Max in our state of affairs:

Alina: Fury Street

The US decides to cripple its personal economic system without end so there isn’t a extra innovation, no productiveness, and all dividends are halted and but our 330 million residents all resolve to go together with it.

Amid the chaos and the dune buggy machine gun battles which rage day and evening on the street, her wealth drains by $100,000 yearly and he or she is all the way down to a single million by age 60. However she retains up the spending and refuses to make any modifications. She’s broke by age 70 however simply sticks to her favourite actions that are rewarding and fascinating however by no means produce a penny of earnings.

Her mortgage checks begin to bounce. The financial institution finally enters foreclosures however she stays glued to that home. After one other 12 months, the foreclosures is full and the sheriff arrives to pull her wiry 71-year-old body out of the home, kicking all the way in which.

Alina is eligible for social packages, however rejects all of them. She has an enormous community of mates, however doesn’t settle for any of their gives for assist or employment.

She checks into a pleasant all-suites resort and begins paying all her payments with bank cards, maxing all of them out together with some money advances to maintain the cash flowing. With the standard methods of steadiness transfers and delayed-repayment plans, she retains the celebration going for 2 extra years, till all of the bank cards have been canceled and despatched off to collections.

At age 73, Alina is lastly out of cash. She can not purchase meals or shelter and he or she has lastly arrived at a actuality that homeless individuals at present expertise every single day proper now. However we needed to make up a completely ridiculous and albeit not possible story to get her there.

I’ll spare you the lengthy story of Dave’s decline, however it’s equally not possible.

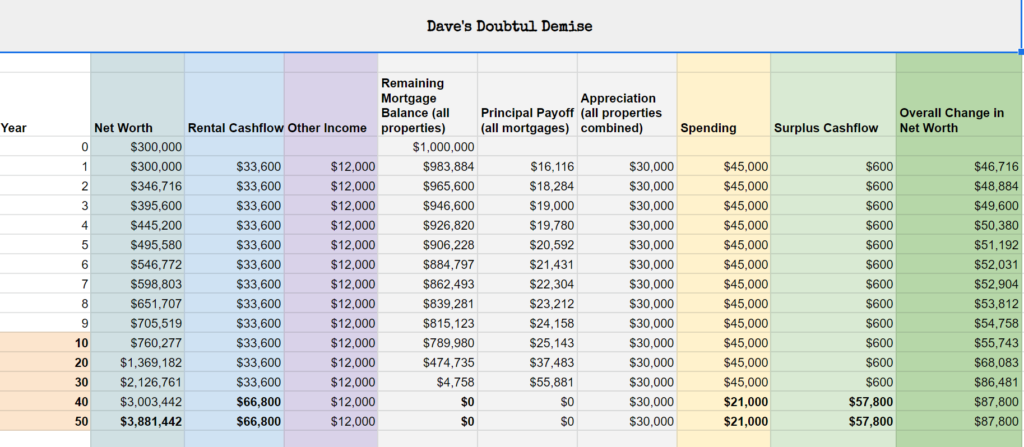

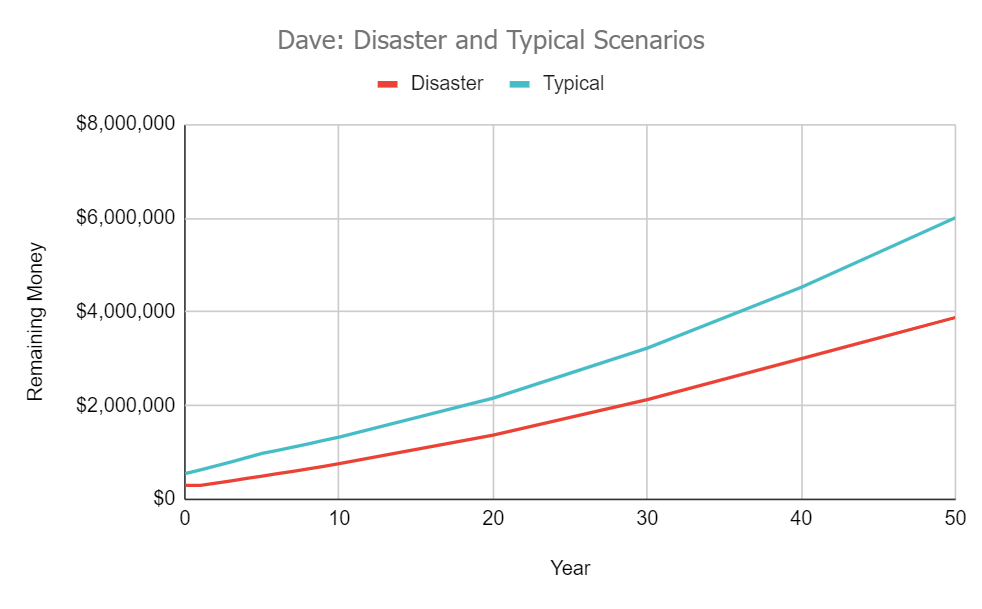

Dave’s Uncertain Demise

If he give up his job at this time, stopped airbnbing his home and simply loved the entire thing and by no means even rented out the decrease degree, forfeited his six-figure 401k account and social safety and all the pieces else besides the rental properties and the $1000 from native gigs, this might occur:

What the heck!?

We threw Dave into the worst of conditions, one thing far past simply quitting his crappy day job and arguably not possible. But not solely does his cashflow proceed to extend, however his internet value skyrockets by about $50,000 per 12 months, ending up at nearly $4 million {dollars} (inflation-adjusted too) by the point he kicks the bucket at 90 years outdated.

In actuality, that purple “different earnings” column is prone to be triple what the spreadsheet says, his 401(ok) account will certainly live on and develop, and lots of different good issues will occur.

Extra Real looking Projections for Each Of My Buddies

For those who’re a pessimist, you might have checked out all of these numbers above and mentioned, “Hmm yeah they made it, however it was slightly shut”. However bear in mind, these had been worst case eventualities. It’s silly to plan all the pieces in your life across the worst case state of affairs, as a result of it would usually lead to you having the minimal attainable quantity of enjoyable.

So as a substitute, it is advisable to a minimum of embrace a conservative estimate of what’s almost definitely to occur. And I’ve carried out so for each Alina an Dave, creating these graphs of the outcomes

So, each of those mates cannot solely give up working, they’ll additionally begin forking out more cash on no matter they need. Congratulations to each of you!

Each of them, and extra importantly a big share of MMM readers, presumably together with YOU, are past the purpose the place they may ever run out of cash even when they give up their jobs at this time.

And they should see this excellent reality for what it’s, in order that they’ll confidently act on it, in order that they’ll cease gifting away valuable months of their lives away to their employers, to amass nonetheless extra chunks of straightforward cash, so as to add to a pile that they are going to by no means, ever, ever want.

After which they’ll begin experiencing precise actuality of early retirement, which is as follows:

- Your spending finally ends up slightly bit decrease than you anticipated, regardless of your greatest efforts to splurge on your self and be beneficiant to others.

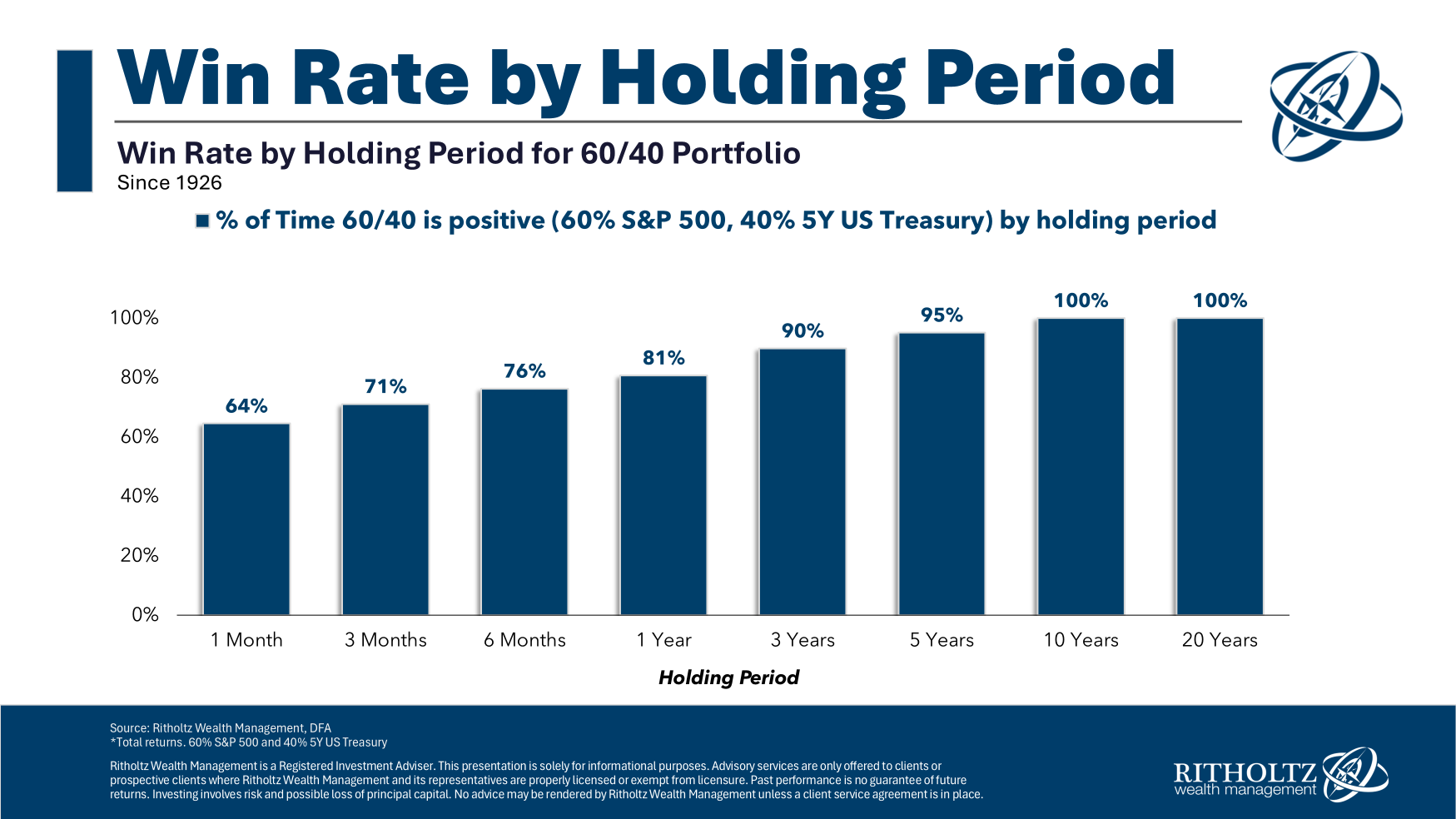

- Your investments do preserve going up over the long term, exceeding these conservative forecasts you made.

- You do find yourself making bits of cash right here and there (in Dave’s case shit-tons of cash), although you completely don’t want it.

- Because the many years move and you agree into this sample, you understand that cash isn’t certainly one of your worries. Life as a Human Being nonetheless presents loads of challenges, however holy shit, thank goodness you give up working while you did as a result of it was fully pointless. Trying again, you most likely ought to have carried out it a number of years earlier.

If any of this sounds acquainted, congratulations – you’ll by no means run out of cash which implies it is advisable to cease letting it rule your life.

Give up your job.

Significantly.

Sheesh. What are you ready for?!

Epilogue: Mr Cash Mustache Chills out for a Splurge too:

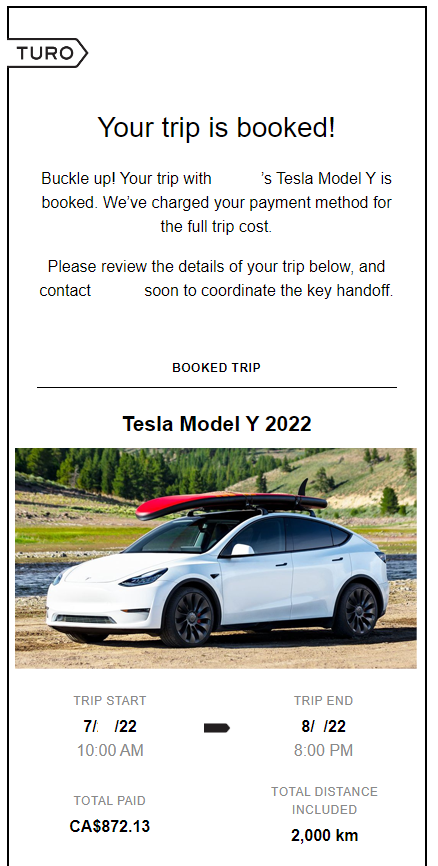

Writing this text jogged my memory that I can also nonetheless be a sufferer of excessively frugal habits. Positive, my home is gorgeous and I’ve nice meals, automobiles, instruments, bikes and all the pieces else. However in relation to journey, I begin taking part in foolish video games with myself.

For instance, my boy and I are heading to Canada later this month to go to the household. And towards all logic, I observed the Nagging Voices of Cheapness beginning to chatter in my head.

“These airplane tickets had been solely $210 every – can I actually justify paying an additional $80 for a much bigger seat on the entrance of the airplane? And sheesh, how can I get across the $150 roundtrip Uber trip (or $150 roundtrip driving+parking) to the airport, that’s ALMOST AS MUCH AS THE PLANE TICKET! Ought to we spend an additional 3 hours roundtrip to avoid wasting $100 by taking the bus?” After which what about our transportation as soon as we’re in Canada? Bus? Automobile rental? Prepare tickets? How does the $7.00 per gallon gasoline issue into this provided that we have to journey over 800 miles throughout our time there?

Blah blah blah. The proper reply is “Shut up, Mustache! It is best to do no matter you suppose is most enjoyable and least hectic, with out fascinated with the cash.”

For me, this implies driving my good electrical automobile on the speedy toll street to the costly Denver Airport car parking zone so we are able to stroll proper into the terminal with no shuttle. It additionally means sitting in airplane seat, after which taking the least hectic and most enjoyable type of transportation as soon as I get there.

Why? As a result of the distinction between the most affordable and most hectic journey, and the costliest one on this case, is just about one thousand {dollars}.

Even when I did this each single 12 months for the remainder of my life, I’d blow $50,000 on luxurious journeys to go to my household (and I may drive my Mother to her a hundred and twenty fifth birthday in model!)

And primarily based by myself worst-case spreadsheet, I’m by no means going to get up and suppose,

“Rattling, if I simply had one thousand extra {dollars}, and even fifty thousand {dollars} extra on this internet value column, I’d be a happier particular person”

So I get to calm down, and revel in my journey, and guess what I even did this:

So I’ll see you in retirement, and possibly even in Canada later this month!

Additional Homework for Spreadsheet Lovers:

I’ve shared a duplicate of the Google Sheets spreadsheet I made for these examples and graphs right here. It is best to be capable of “file->make a duplicate” to get an editable model to fiddle with. Mine are fairly primary and miss some particulars so as to keep away from getting any extra difficult than they already are, however be at liberty so as to add extra in case you like,

Within the Feedback:

Are you too fearful, or too optimistic, or someplace in between? You probably have already give up your job, how did you get the arrogance? For those who’re nonetheless caught in One Extra 12 months Limbo, what wouldn’t it take to get you out of it?