When will every little thing, all over the place be open? Oh, round 10:33 – Cyber Tech

I had a chat with a pal the opposite day about Open Banking and so they requested if I’d heard about 1033. 1033? Is {that a} PIN code for his or her money?

No. Because it seems, 1033 is the part of the USA’s Shopper Monetary Safety Act that may introduce Open Banking to our American pals. Yow will discover out all of the deets right here:

“In October 2023, the Shopper Monetary Safety Bureau (CFPB) proposed a rule to speed up the shift to open banking and set up stronger monetary knowledge rights. The proposed rule, which might be the primary to implement Part 1033 of the Shopper Monetary Safety Act, would require banks and different knowledge suppliers to assist customers entry and share their monetary knowledge by secure, safe, and dependable developer interfaces (APIs).”

Fascinating. However what’s Part 1033?

“Part 1033, a part of Dodd-Frank, provides customers the correct to entry and share their monetary knowledge. Part 1033 requires monetary companies suppliers to make accessible to customers – and representatives appearing on their behalf – sure info in these suppliers’ management. This may embody info like a shopper’s transactions or the stability of their monetary account.”

OK, so America is lastly catching up with Open Banking. Why is that this essential?

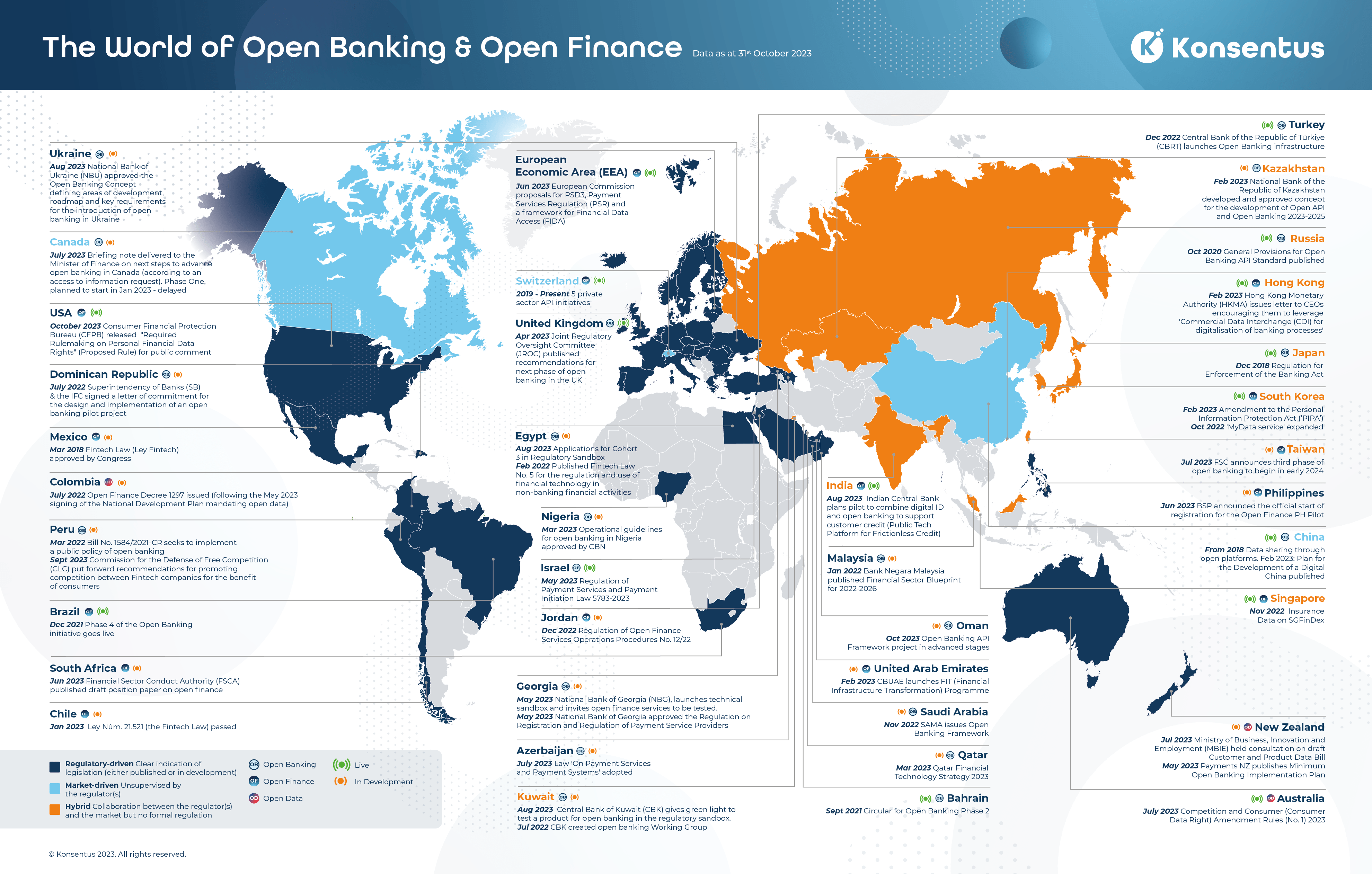

Nicely, I assume the entire world is shifting to open, linked monetary methods that encourage banks to accomplice with hundreds of attainable companions. That is one thing I’ve argued for years, and now it’s lastly occurring all over the place. The difficulty is that an terrible lot of banks don’t know what’s truly occurring.

What I imply by that is that there are nonetheless many banks who will not be partnering, not collaborating, not curating the monetary ecosystem. It’s like that outdated quote:

“There are those that make issues occur, those that watch what’s occurring and people who ask what occurred.”

An terrible lot of banks are falling into the second two classes. Meantime, the Open Banking motion is certainly within the first camp.

Take Open Banking Ltd who’s CEO Henk Van Hulle notes that there are “greater than 8 million lively customers of open banking within the UK, and in November 2023 we noticed a report 12.85m open banking-enabled funds made – this can be a year-on-year development of 78.5% (from 7.2m funds in November 2022). As large tech begins to return on board with open banking, I predict that we are going to see funds double within the house of simply two years.”

The UK carried out Open Banking eight years in the past. The USA is doing it quickly. It’s not well-liked with everybody however, by the top of this decade, I reckon that each nation, all over the place shall be open. Oh, they already are!