What About 60/30/10 As a substitute of 60/40? – Cyber Tech

A reader asks:

Ben all the time shares the long-run returns for shares, bonds and money. It’s primarily 10%, 5% and three%. I do know previous will not be predictive, blah, blah, blah however am properly conscious that money has the bottom potential returns of the principle asset courses.

Realizing this full properly, I nonetheless need to maintain 10% of my portfolio in money in retirement so I can sleep at evening. Would a 60/30/10 portfolio actually be that a lot worse than a 60/40?

I like this query as a result of it will get right down to the concept of optimization vs. habits.

Feelings all the time win out over spreadsheets which is why understanding the lesser elements of your self is so vital as an investor.

Money does have the bottom anticipated return of all the principle asset courses. Shares and bonds are riskier than money which is why they need to have greater anticipated returns.

I’ve no downside with a behavioral launch valve in your portfolio so long as you perceive the trade-offs.

I’ve reviewed the historic long-run returns for shares, bonds, and money on quite a few events, so let’s have a look at some more moderen efficiency numbers.

These are the annual returns1 within the 10, 20, 30 and 40 years ending 2023 for each a 60/40 portfolio and a 60/30/10 portfolio:

The returns for the extra cash-heavy portfolio have really been higher than the 60/40 portfolio over the previous 10 years. That is sensible contemplating we simply lived via the worst bond bear market in historical past.

Bonds have had higher returns over the previous 20, 30, and 40 years, however the annual returns should not markedly higher for a 60/40 portfolio than a 60/30/10 portfolio over the long run.

You quit some return however it’s not the tip of the world.

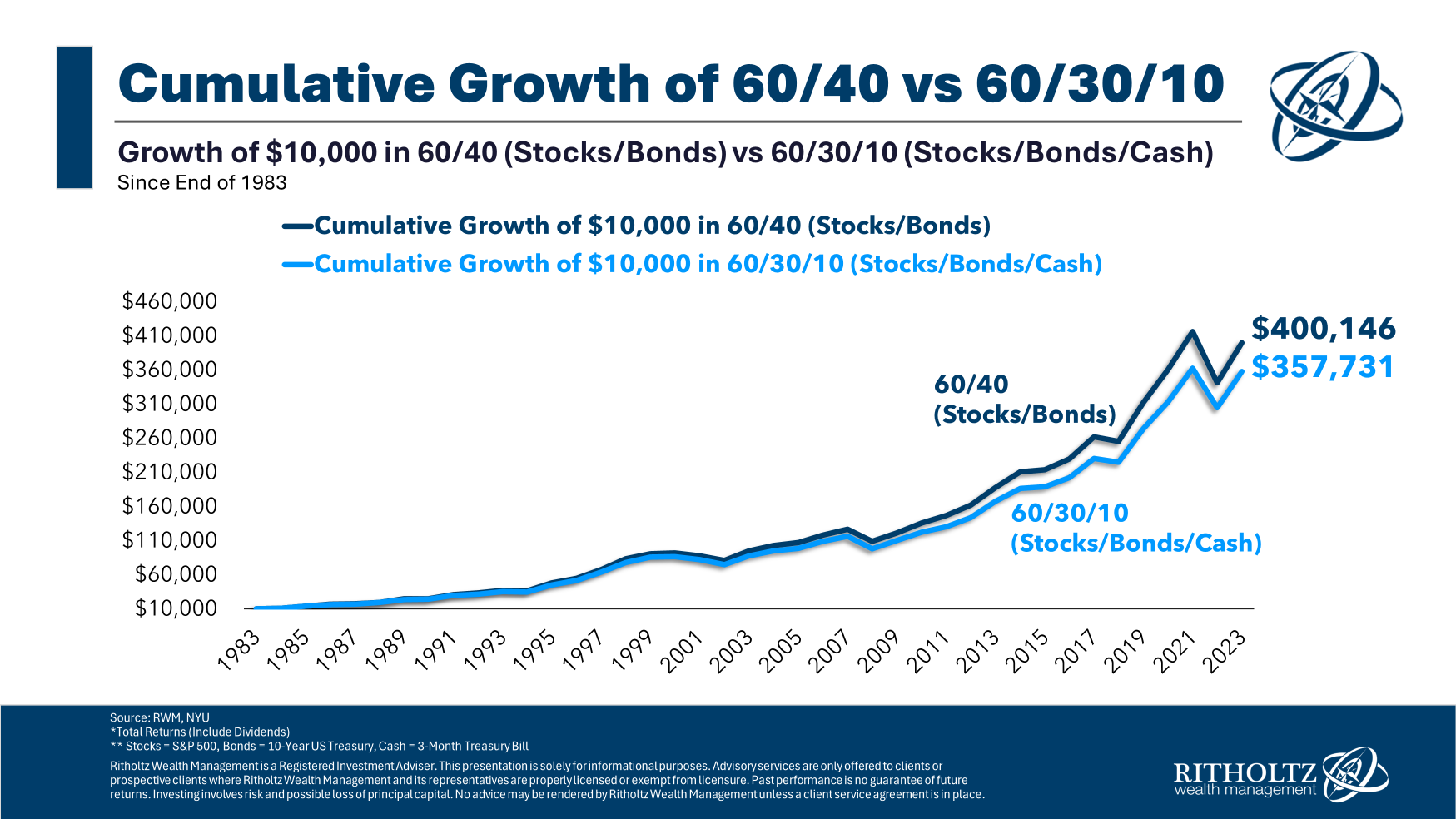

Here’s a have a look at the expansion of $10,000 in every portfolio over a 40 12 months time-frame:

You’ll have ended up in a greater place for those who didn’t have the money drag, however once more, it’s nonetheless comparatively shut. And the hole can be smaller over shorter time frames.

I’m not a fan of going to portfolio extremes. Buyers who attempt to get out of the inventory market fully by going to money after which getting all the best way again within the inventory market normally fail. That’s not investing; it’s hypothesis.

There’s a distinction between going all in or all out and carving out a small allocation in your portfolio for behavioral functions. If having that 10% piece of your portfolio means that you can keep invested within the different 90%, that’s a win.

Many traders have a tough time ever attending to a spot the place they’ll admit they want a behavioral launch valve. Realizing thyself is a large a part of the investing course of.

There isn’t a such factor as the proper portfolio but when one did exist most individuals most likely wouldn’t be capable of keep invested in it anyway.

The suboptimal technique you’ll be able to persist with is way superior to the optimized technique you’ll be able to’t persist with. The appropriate allocation is the one which matches your danger profile, time horizon, and temperament.

Lengthy-term returns are solely helpful you probably have the power to stay it out in the course of the short-term.

We talked about this query on the most recent version of Ask the Compound:

Invoice Candy joined me on the present once more to debate questions on paying down a mortgage to refinance it later, donating inventory to charity, ETFs vs. mutual funds and methods to diversify your tax scenario.

Additional Studying:

A Brief Historical past of the 60/40 Portfolio

1I used an annual rebalance for each allocations.

This content material, which comprises security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will probably be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or provide to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here:

Please see disclosures right here.