The clear decline of money and playing cards and rise of wallets [stats and research] – Cyber Tech

For over twenty years, I’ve predicted the top of the ATM, money and playing cards. Lastly, a lot of these predictions look like coming true. It’s definitely true of money versus card …

… and now it’s turning out to be true for card versus pockets …

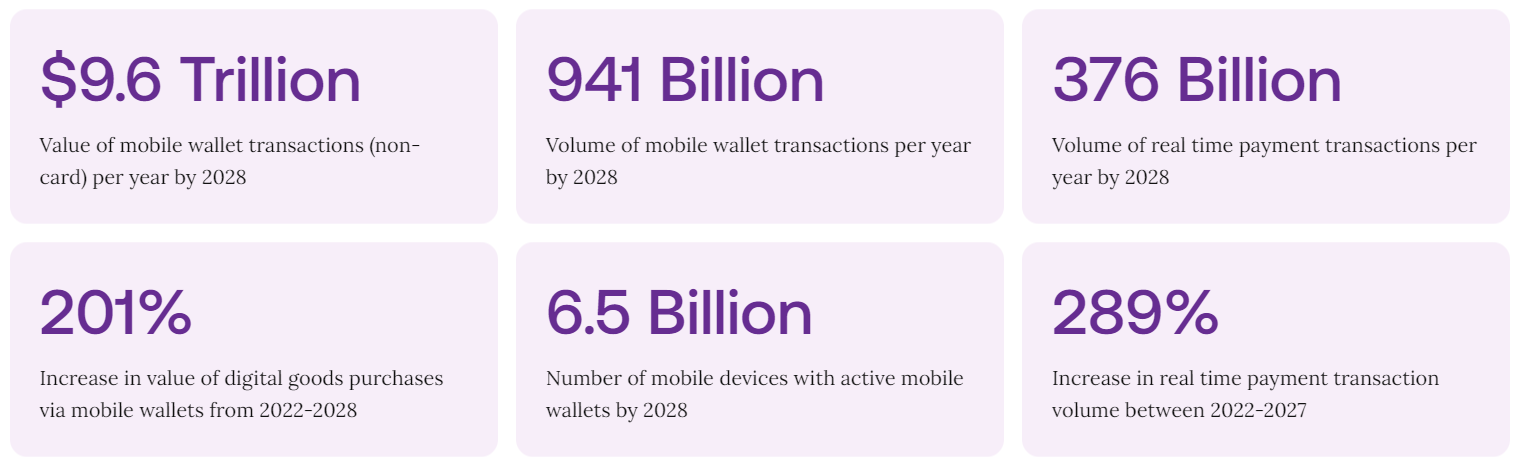

Admittedly, the second image is from a cellular funds supplier and promoter known as Boku, however their analysis does create a stark context and glum future for the massive card community suppliers, specifically Visa and MasterCard.

The report highlights that in opposition to a backdrop of continued sturdy development in ecommerce, the worldwide card schemes proceed to lose share of checkout to regional and native cost strategies comparable to digital wallets, account-to-account funds, service billing and BNPL choices. This can be a pattern seen at an combination world stage but additionally repeated in each area internationally.

The important thing developments within the report is an enormous shift over the following 5 years from credit score and debit card to pockets and account-to-account (A2A) funds. Their report reckons that 58% of all ecommerce transaction worth globally can be processed by native cost strategies by 2028. In actual fact, they forecast that just about $10 trillion of funds can be made through mobiles by 2028.

That’s nice, however let’s slender it right down to Europe. Their particular proposition is that Europeans will transfer away from bank cards. Bank card funds on-line (cellular and web) will drop from 31% in 2022 to simply 15% in 2028. To be clear, Europeans will halve their funds by bank card. Equally, debit card funds will drop from 13% on-line to simply 8%, a close to halving of debit card funds.

It’s because playing cards are being changed by wallets and A2A funds.

Admitting the bias on this report – it’s a web-based funds enabling firm that did it – I discover myself a bit bemused. Why? As a result of I’ve been forecasting the top of playing cards and money for years. Now, I’m forecasting the top of wallets and A2A funds. That’s the issue whenever you deal with the longer term. You may all the time see a cycle of delivery, development, doom and gloom.

So, what’s the difficulty with cellular wallets? The difficulty is that they’re cellular wallets. They have to be embedded wallets usable all over the place, everytime for everybody. That’s the place we’re going of us.

As we transfer to the augmented, embedded world of cash, we might simply handle all the pieces through gadgets linked 24*7. Neglect money, playing cards and wallets, it’s simply all over the place.

One other issue is that, even when playing cards are useless, they are going to nonetheless be round. Cellular wallets are normally backed by a card quantity and expiry date. The cardboard issuer and acquirer are nonetheless concerned. So playing cards as a bodily object could also be useless, however card acquisition remains to be very a lot alive.

Due to this fact, though Boku’s analysis claims that Visa and MasterCard are on their final legs, I don’t agree. In actual fact, I’d go so far as saying that, in twenty years, there can be no playing cards or money round, besides in distinctive circumstances, however there’ll nonetheless be card issuers and acquirers who again IoT embedded finance and, almost certainly, their names can be Visa and MasterCard and never Boku.

Debate?

Postscript: hat tip to my good friend Efi for this report.