Charge Cuts & Historic Market Analogues – Cyber Tech

Finding out market historical past has made me a greater investor.

Calculating historic efficiency information is considered one of my go-to strikes for this weblog. It helps present some perception into the potential dangers and vary of outcomes within the markets.

Market historical past additionally helps preserve you grounded.

It’s vital to grasp the booms and busts — the South Sea Bubble, the panic of 1907, the roaring 20s, the Nice Despair, the Nifty Fifty, the nice inflation of the Seventies, the 1987 crash, the Japanese asset bubble of the Eighties, the dot-com increase & bust, the Nice Monetary Disaster and extra.

These durations assist outline the human situation — from worry to greed, panic to euphoria, jealousy to the worry of lacking out and extra.

However market historical past requires context and perspective. It will probably aid you put together however it’s not a foolproof strategy to predict what comes subsequent.

As Warren Buffett as soon as wrote, “If previous historical past was all that’s wanted to play the sport of cash, the richest individuals can be librarians.”

For instance, pondering by way of the present financial regime has been troublesome for traders and pundits alike.

In 2022, everybody assumed a recession was a foregone conclusion primarily based on historic analogues (inverted yield curve, excessive inflation, and so forth.). It didn’t occur.

Now inflation looks as if it’s beneath management and the Fed is reducing charges with the inventory market at all-time highs.

And it appears like this implies both the coast is evident or we’re on the verge of a collapse.

It’s exhausting to consider however we have now been on this scenario earlier than (form of).

I had our analysis group have a look at the ahead 12-month returns from each preliminary Fed fee lower since 1957:

You may also see a breakdown of whether or not that preliminary fee lower got here when the market was inside 5% of all-time highs or not.

The one-year returns following the primary Fed fee lower have been fairly good.

The common returns are, nicely, common. And 5 out of seven instances when the Fed began reducing charges close to all-time highs, the market was increased 12 months later.

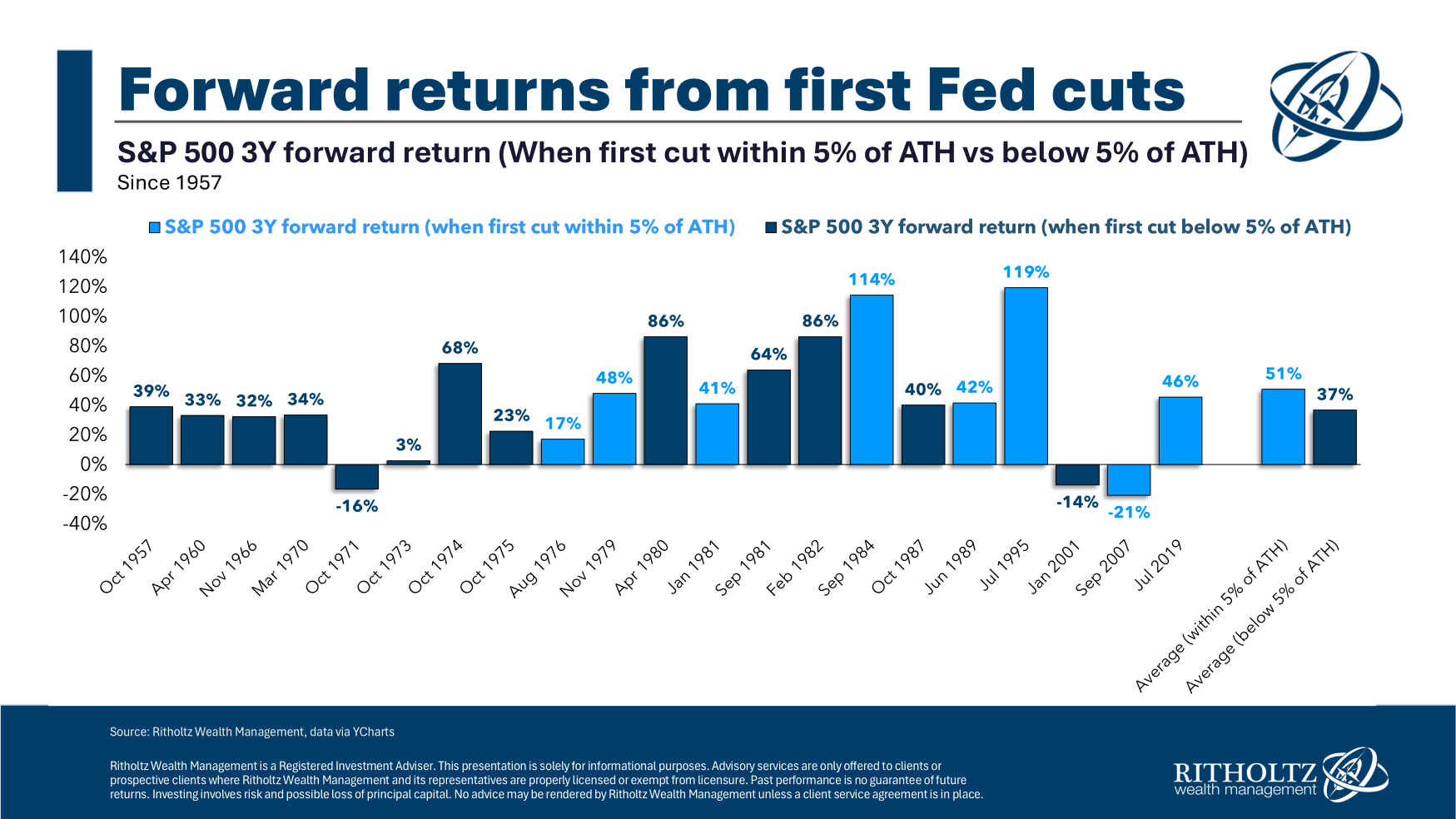

Right here’s the identical breakdown displaying three-year ahead returns:

Once more, fairly good. Six out of seven instances the inventory market was increased 36 months later when the market was near all-time highs.

That is excellent news for traders. More often than not, issues have labored out simply high quality when the Fed cuts charges near all-time highs.

This is smart intuitively, too. Simpler financial coverage ought to be good for companies.

Nevertheless, I’m additionally wish to supply some warning when eager about what comes subsequent within the present iteration. We’ve by no means really seen something like the present surroundings.

Right here’s an incomplete checklist of what makes this case distinctive:

- We’re nonetheless normalizing from the pandemic.

- There have been trillions of {dollars} in authorities spending.

- The inventory market has been in a ~15 yr bull market.

- Rates of interest have been all around the map.

- The U.S. has skilled simply two months of recession since June 2009.

Plus, there’s the truth that the Federal Reserve has by no means been extra clear than it’s right this moment. Buyers prior to now needed to guess what the Fed thought. Now, they received’t shut up about it.

The reality is I don’t know.

It’s useful to know that Fed fee cuts at and round all-time highs haven’t spelled doom prior to now.

However it’s additionally true that the inventory market has been up most of the time over most 12- and 36-month durations traditionally.

Historical past is useful up to some extent however issues which have by no means occurred earlier than appear to occur on a regular basis today.

Human nature is the one fixed throughout all market and financial cycles however people are extremely unpredictable.

For that motive, markets are unpredictable too.

Additional Studying:

The Inventory Market By no means Adjustments