Is digital banking completed? – Chris Skinner’s weblog – Cyber Tech

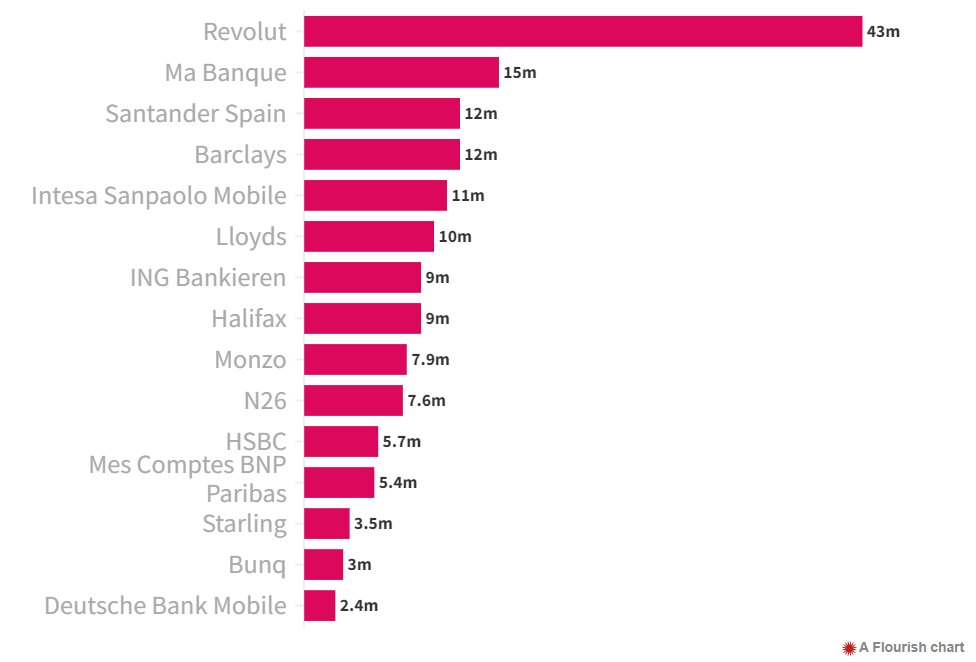

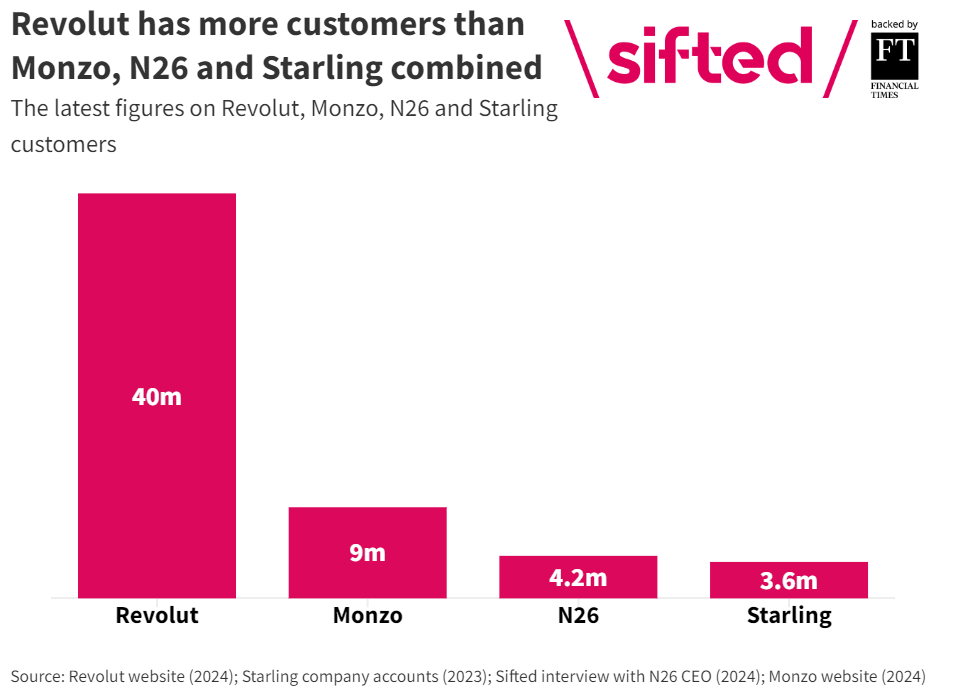

As Revolut studies exceeding 40 million clients throughout Europe and Monzo raises $430 million at a $5 billion valuation, many individuals are considering that the challengers are now not challengers. They’re banks. Placing it in context, within the UK, NatWest have 14 million retail clients; Monzo has over 9 million. The challenger has matured. But, when studying numerous information studies on such corporations, there are doubts. For instance, The Monetary Instances argues that the brand new banks haven’t materially modified UK banking however simply provide a boutique service for day-to-day funds. They quote numerous people and finish with this one:

“It’s foolish to counsel that neobanks have materially challenged the hegemony of conventional establishments. Arguably, their solely lasting affect is pushing massive banks to enhance their very own digital platforms.” Alex Barkley, managing associate at Lancero Capital.

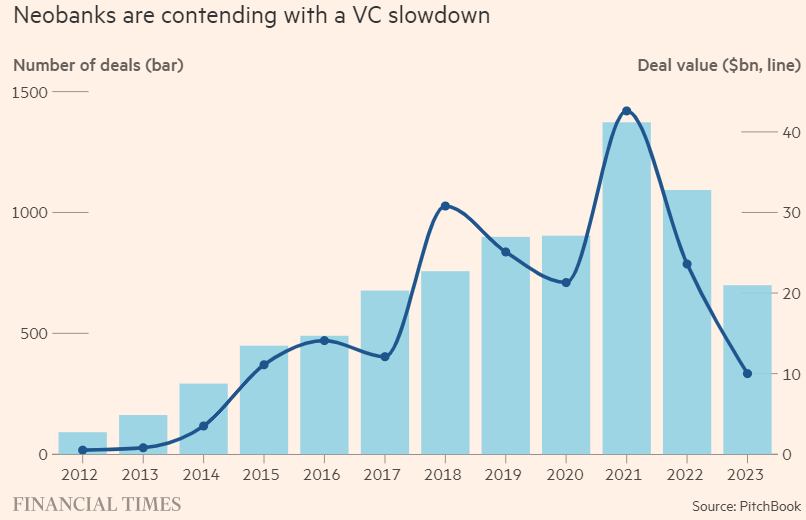

It’s an fascinating take and, particularly, the FT’s take is that with investor funding drying up and an absence of product range, their future is unsure.

I’m not so certain. As talked about yesterday, some folks consider digital banking is completed and there could be no level in investing in a brand new digital financial institution. I disagree as there may be nonetheless some option to go. For instance, take into consideration when Monzo and Starling had been launched. All the excitement was about PFM (Private Monetary Administration). In the present day, it’s all about AI. Tomorrow, it’s all about Quantum. There’s at all times area for a brand new contender.

That’s why it’s fascinating once you have a look at an organization like NuBank in South America. Sifted studies that: “Brazil’s Nubank made neobanking historical past by saying that it had reached 100m clients, 11 years after its launch and two years after it listed on the New York Inventory Trade.

“It’s the primary time {that a} neobank outdoors of Asia has hit the milestone and comes scorching off the information that it made $1bn in revenue and $8bn in income final 12 months. These are numbers that Europe’s big-name neobanks — Monzo, Starling, Revolut and N26 — may solely dream of.”

The factor is that NuBank targeted upon the unbanked and underbanked – an enormous inhabitants within the South American markets – and subsequently had totally different alternatives and challenges to the UK and European challengers. Meantime, there are vital strikes in Europe between the outdated banks, new banks and neobanks. Once more, on the head of the pack, is Revolut. Why? As a result of, in line with Sifted, Revolut has In contrast to Nubank — and its European friends — Revolut has “blitzscaled”.

It’s to this point launched in 37 nations and is offered in an additional 14 territories and nations, together with Chile, Azerbaijan and Kazakhstan, the place it capabilities largely as a cash switch app with some crypto buying and selling companies.

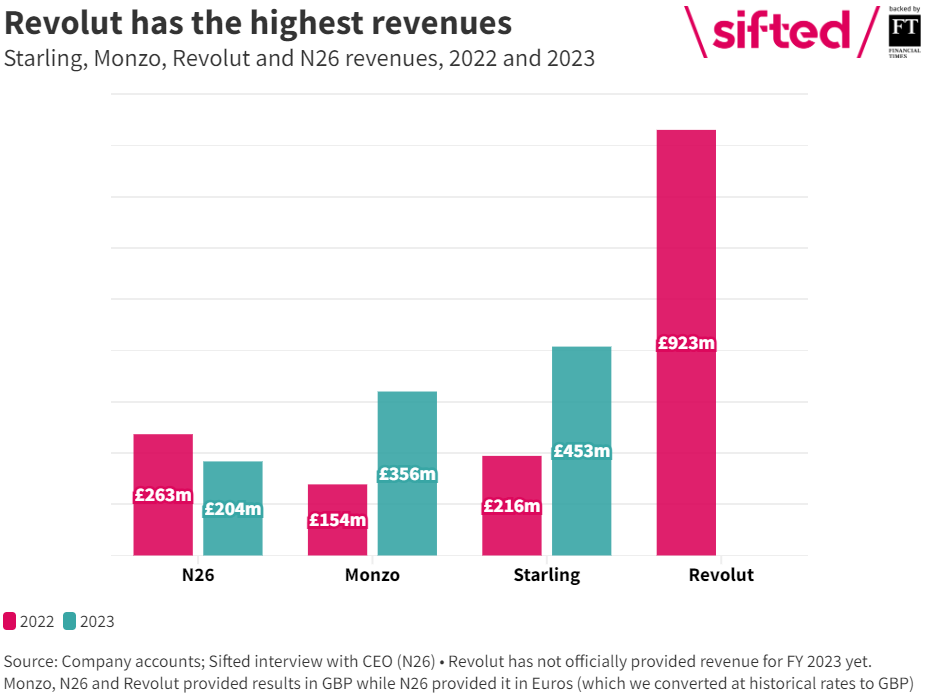

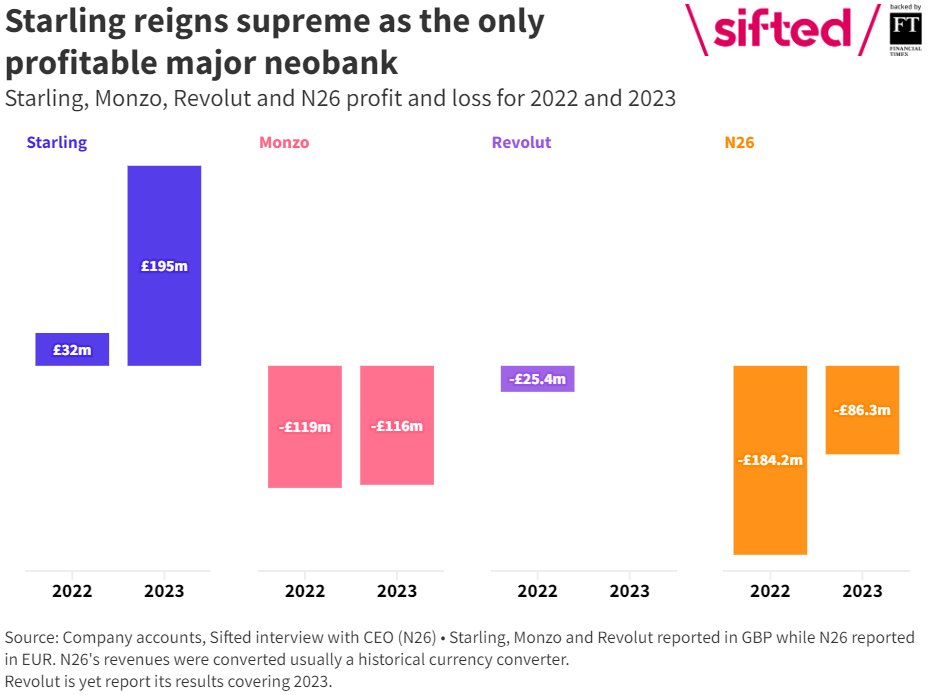

That doesn’t imply it’s all of the yellow brick highway for Revolut. Actually, there’s a little bit of a rocky highway as interchange charges are round a 3rd of its £923 million in income reported in 2022, while overseas alternate and wealth drove £270m in income for the enterprise and, regardless of making near a billion in income, the neobank sunk again into the purple with a pre-tax lack of £25.4 million after reporting a £39.8 million of revenue the earlier 12 months.

That’s moderately totally different to Starling Financial institution, who made a pre-tax revenue of £195 million final 12 months with £453 million in complete income by means of a unique focus of lending to small and medium-sized enterprises (SMEs).

All in all, I’d agree that sure, digital banks are rising up. From being referred to as challengers and neobanks, they’re now fully-fledged digital banks. Nevertheless, that doesn’t imply there’s no room for one more one. One other one that’s 100% Generative Finance …