Election Market Overreactions – A Wealth of Frequent Sense – Cyber Tech

When Barack Obama was elected president the U.S. financial system and markets have been in tough form.

From the height in October 2007 by means of election day the S&P 500 was already within the midst of a 35% drawdown. By the point he was inaugurated in January 2009, the market was down almost 50% in whole.

By March, a Bloomberg opinion piece was calling it the “Obama Bear Market”:

President Barack Obama now has the excellence of presiding over his personal bear market. The Dow Jones Industrial Common has fallen 20 p.c since Inauguration Day, the quickest drop beneath a newly elected president in at the very least 90 years, based on knowledge compiled by Bloomberg.

Michael Boskin of Stanford’s Hoover Establishment wrote an op-ed within the Wall Avenue Journal on March 6, 2009 with the next headline: “Obama’s Radicalism Is Killing the Dow.” He defined:

It’s laborious to not see the continued sell-off on Wall Avenue and the rising concern on Foremost Avenue as a product, at the very least partly, of the conclusion that our new president’s insurance policies are designed to radically re-engineer the market-based U.S. financial system, not simply mitigate the recession and monetary disaster.

The inventory market bottomed three days later.1

From the day that op-ed was revealed by means of the rest of Obama’s phrases in workplace, the S&P 500 was up 230% in whole.

All of the speaking heads have been improper, principally as a result of folks have been caught in a doom loop from the Nice Monetary Disaster.

The speaking heads have been improper when Trump took workplace after Obama as properly.

Paul Krugman2 from the New York Instances made the next prediction the day after the election:

Nonetheless, I assume folks need a solution: If the query is when markets will get better, a first-pass reply is rarely.

The catastrophe for America and the world has so many elements that the financial ramifications are manner down my checklist of issues to concern.

Dallas Mavericks proprietor Mark Cuban made an identical assertion earlier than Trump was elected:

Within the occasion Donald wins, I’ve little question in my thoughts the market tanks. If the polls seem like there’s an honest probability that Donald might win, I’ll put an enormous hedge on that’s over 100% of my fairness positions… that protects me simply in case he wins.

The inventory market did simply superb throughout Trump’s presidency, gaining greater than 90% in whole from inauguration day to inauguration day.

Trump himself was the one who predicted the inventory market would crash if Biden have been elected in 2020:

The inventory market did simply superb beneath Biden too, up greater than 90% since he took workplace in January 2020.

Typically instances these predictions are politically motivated, however they’re additionally pushed by the momentum of the day. There’s plenty of herding after an election.

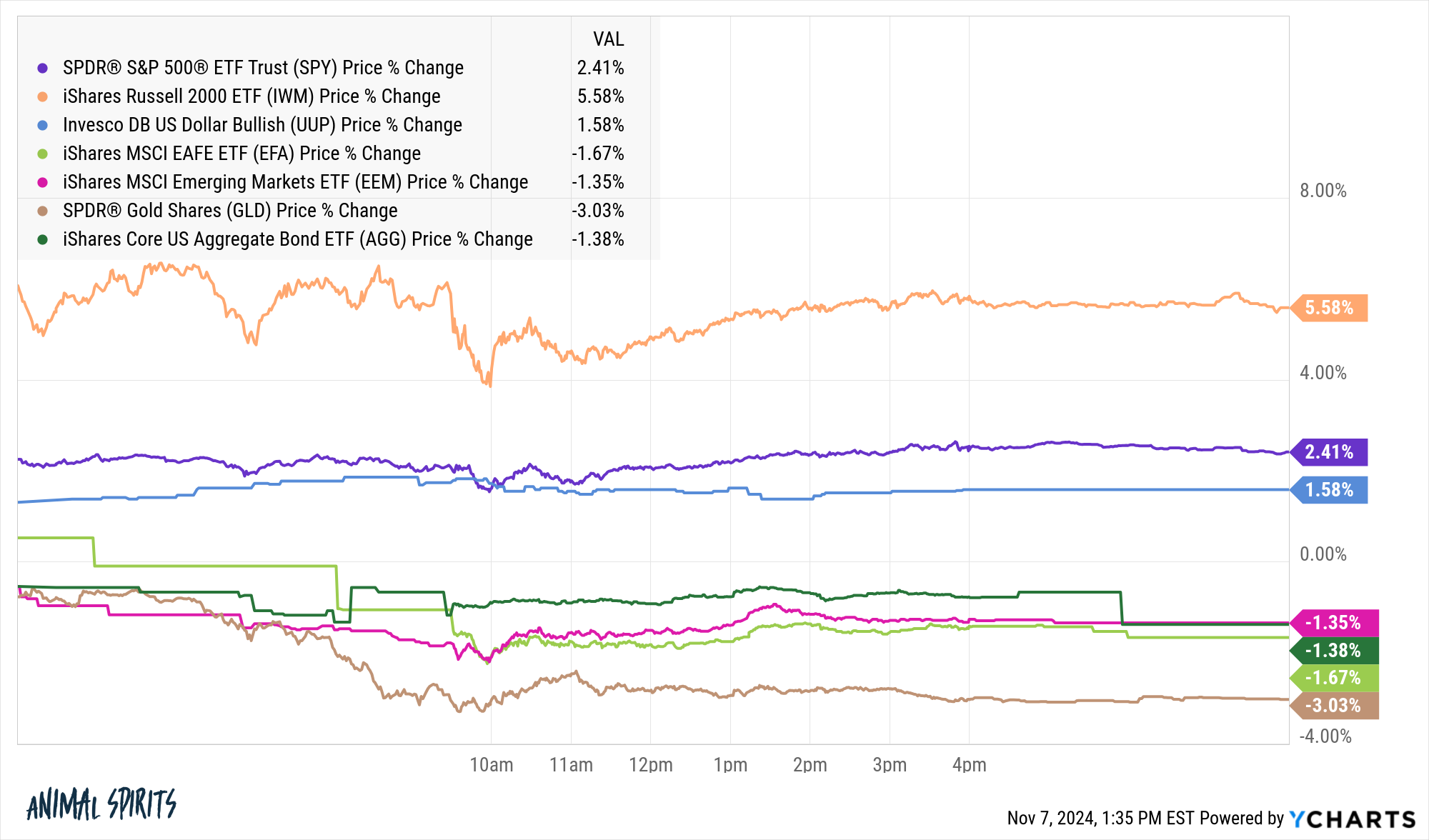

Which brings us to the present election. The market’s response was resoundingly constructive the day after Trump was elected:

Right here’s the abstract:

- The S&P 500 was up bigly (+2.4%)

- Small cap shares have been up massively (+5.6%)

- The U.S. greenback was up (+1.6%)

- Overseas and rising market shares have been down (-1.7% and -1.4%)

- Gold was down (-3.0%)

- Bonds have been down (-1.4%) as a result of charges have been up

- Bitcoin additionally charged to new all-time highs.

That was actually a giant response contemplating the inventory market was already up 20% in whole coming into election day.

Nobody appears to be making any crash predictions this time round. It’s (principally) all people within the pool. I’m virtually sure markets are overreacting in a roundabout way right here however I can’t say for certain the place it’s going down.

Small caps have given buyers loads of head-fake rallies over time. Rates of interest have been rising and falling for a few years now too. It looks as if a sure-thing bitcoin goes to learn however crypto’s historical past is affected by booms adopted by busts.

If I needed to decide one I believe buyers are too apprehensive concerning the rise in charges. We’ll see. I’m no good at predicting these things.

I assume what I’m attempting to say right here is don’t take the preliminary response of the markets, the pundits or the economists as gospel. Nobody is aware of how this can prove, good or dangerous.

The issue with politicians is that they make many guarantees on the marketing campaign path, a lot of which by no means come to fruition. So the markets are guessing about what’s going to occur earlier than now we have any of the small print. That is what markets do, after all. Typically proper, generally improper however by no means doubtful.

Making predictions primarily based on short-term value actions is at all times a idiot’s errand but it surely’s in all probability much more vital to keep away from overreacting after an election when feelings are operating excessive.

Josh, Michael, Callie and I went reside at The Compound on Wednesday night to speak all concerning the market and financial impacts of the election:

And Michael and I gave some ideas on politics and investing the day earlier than the election:

Be sure to subscribe to The Compound’s YouTube channel so that you by no means miss any of those movies.

Additional Studying:

Don’t Combine Politics With Your Portfolio

Now right here’s what I’ve been studying recently:

- The 2024 election and who tells your story (Eye on the Market)

- Slaying a few of the largest passive investing boogeymen (FT)

- Investing classes from the 2024 election (Huge Image)

- We have to discuss retirement spending (Morningstar)

- Methods to cope with disappointment (The Atlantic)

Books:

1On March 3, 2000, Obama stated it could be a very good time to purchase shares. He wasn’t pounding the desk but it surely’s humorous how there was truly pushback on that concept on the time.

2To be truthful, Krugman did recant that assertion a couple of days later.