Do we want CBDCs? – Chris Skinner’s weblog – Cyber Tech

Everybody appears to be speaking about CBDCs: Central Financial institution Digital Currencies. They’re being launched to stem the tide of cryptocurrencies, however it makes you ask: what’s the distinction. A CBDC is backed by a authorities; a cryptocurrency is backed by decentralised democracy. Not a lot distinction there then.

The Financial institution of England defines CBDC as “cash {that a} nation’s central financial institution can difficulty. It’s known as digital (or digital) as a result of it isn’t bodily cash like notes and cash. It’s within the type of an quantity on a pc or comparable gadget”. They then issued a session paper if you wish to know extra.

So why do we want a CBDC?

There are various views, and the core one is that it’s underwritten by a government. A central financial institution and a state authorities. However then the subsequent query is whether or not a CBDC ought to be out there as solely G2C or G2B2C. What? Authorities to client, like money; or Authorities to Financial institution to Client. Most governments have settled on the latter mannequin, in order to keep away from disrupting the present system, however there may be nonetheless a debate about whether or not CBDCs ought to be issued by way of industrial banks or direct to client.

McKinsey clarify the totally different approaches nicely:

There’s nobody kind of CBDC; a broad number of approaches are being piloted in numerous international locations. One kind of CBDC is an account-based mannequin, comparable to DCash, which is being carried out within the Japanese Caribbean. With DCash, shoppers maintain deposit accounts straight with the central financial institution. On the reverse finish of the spectrum is China’s e-CNY, a CBDC pilot that depends on private-sector banks to distribute and preserve digital-currency accounts for his or her clients. China showcased e-CNY through the 2022 Olympic Video games in Beijing. Guests and athletes may use the forex to make purchases throughout the Olympic Village.

One other mannequin is the one into consideration by the European Central Financial institution by which licensed monetary establishments every function a permissioned node of the blockchain community as a conduit for the distribution of a digital euro. A last mannequin, in style with “cryptophiles” however not but totally trialled by central banks, is the place fiat forex (forex that’s authorities issued however not backed by a commodity) can be issued as nameless fungible tokens to guard customers’ privateness.

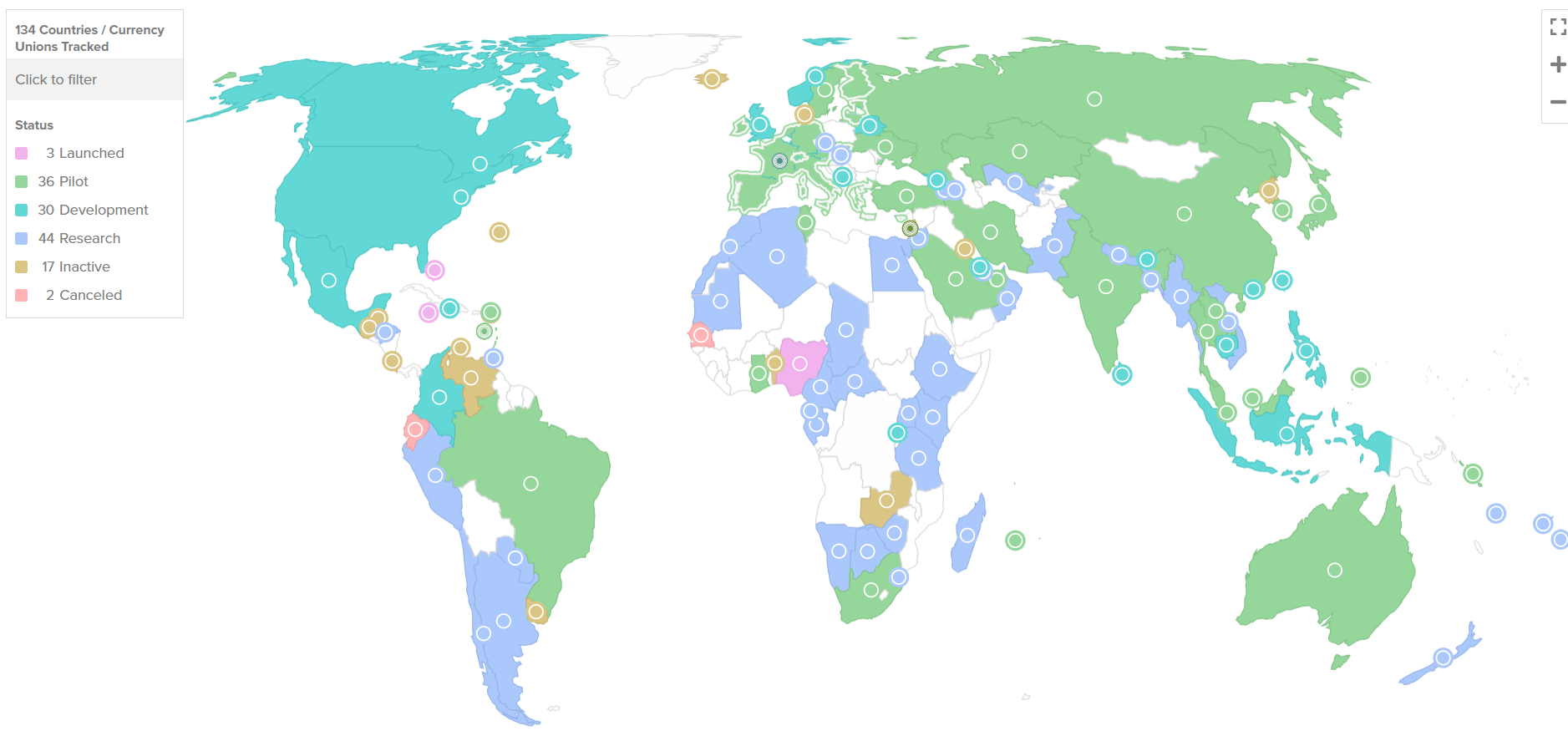

Apparently, my favorite CBDC tracker with the Atlantic Council exhibits that nearly each nation on the earth is creating, experimenting, piloting and possibly even implementing CBDCs.

The factor is: will we really want CBDCs and what are the dangers?

Properly, the Financial institution of England and HM Treasury establish various motivations for doing this. The first motivations for the digital pound are the provision of central financial institution cash as an anchor for confidence and security in cash, and selling innovation, selection, and effectivity in funds.

While there are societal and financial advantages to the digital pound, potential dangers have additionally been voiced. The Home of Commons Treasury Committee, for instance, word it may deliver new dangers and challenges, together with dangers to monetary stability if shoppers en masse had been to change financial institution deposits into digital kilos during times of monetary market stress.

There are additionally issues about monetary inclusion, which may undergo if the digital pound had been to speed up the decline of money, inflicting potential difficulties for these reliant on bodily money.

From a European standpoint the motivations and dangers are somewhat totally different and probably extra excessive. They word that buyers are abandoning money in favour of digital funds and are fearful in regards to the penalties:

Are shoppers too reliant on US card networks, which not too long ago withdrew their providers from Russia, demonstrating that even non-public fee techniques can turn out to be drawn into worldwide conflicts?

Are various techniques wanted to enhance the financial system’s resilience to system outages, pure disasters or cyberattacks?

Does it matter if there is no such thing as a longer a public various to personal fee providers like card funds?

Will shoppers who worth the privateness of money undertake riskier alternate options like Bitcoin or stablecoins, a few of which have been not too long ago confirmed to be unsafe shops of worth?

No matter your view, your nation, your operation and your wants, there may be an inevitable motion in direction of digital currencies, whether or not you prefer it or not. Many international locations are researching or creating central financial institution digital currencies, and three have carried out them.

Particularly, it’s seen as essential for monetary inclusion, as a result of many individuals don’t have any entry to financial institution accounts, so a CBDC would give them a method to be paid, maintain their cash, and pay payments digitally … until they don’t have a cell phone.