Apple, We Imagine, Can Attain $328/Share – We Charge At Maintain (NASDAQ:AAPL) – Cyber Tech

FlashMovie/iStock through Getty Photographs

DISCLAIMER: This notice is meant for US recipients solely and, particularly, will not be directed at, nor meant to be relied upon by any UK recipients. Any info or evaluation on this notice will not be a proposal to promote or the solicitation of a proposal to purchase any securities. Nothing on this notice is meant to be funding recommendation and nor ought to or not it’s relied upon to make funding selections. Cestrian Capital Analysis, Inc., its workers, brokers or associates, together with the writer of this notice, or associated individuals, could have a place in any shares, safety, or monetary instrument referenced on this notice. Any opinions, analyses, or possibilities expressed on this notice are these of the writer as of the notice’s date of publication and are topic to alter with out discover. Corporations referenced on this notice or their workers or associates could also be prospects of Cestrian Capital Analysis, Inc. Cestrian Capital Analysis, Inc. values each its independence and transparency and doesn’t imagine that this presents a cloth potential battle of curiosity or impacts the content material of its analysis or publications.

Underneath-Owned And Underneath-Appreciated

Apple Inc. (NASDAQ:AAPL), as everybody is aware of, has its finest days behind it. The speed of innovation has slowed, competitor merchandise are regularly superior, the units are too costly and blah.

Properly, that could be, however the inventory would not agree. Having put in a sideways accumulation sample from April 2023 till earlier this month, the inventory simply broke out right into a bullish sample which, we imagine, can run till $328 or so.

Permit me to elucidate that opinion. Happy to debate and debate it within the feedback to this text, as all the time.

Apple Inventory Evaluation

Let’s take care of that chart first, then let’s flip to the underlying fundamentals which, I imagine, present supporting proof for the notion of a continued run-up for the inventory.

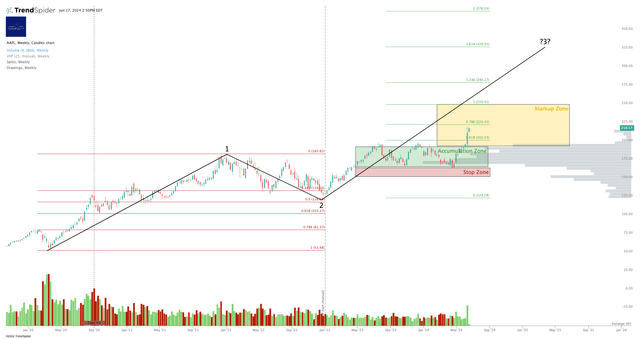

AAPL Chart (Cestrian Capital Analysis, Inc // TrendSpider)

The chart begins from the Covid disaster low, which more and more appears to be like like a righteous “commerce level zero” for many all of the charts we do. As you understand, the violent about-turn in Fed liquidity provision plus the affect of 2020 Q1 quarterly choices expiry began an enormous rally in equities; the rally was additional fueled by plentiful brought-forward spending on know-how merchandise made by the businesses which dominate the S&P 500 (SP500) and the NASDAQ 100-Index (NDX); and the rate-hike cycle that adopted delivered a brutal correction in 2022, organising for the rally we have now seen in 2023-4 to this point.

Seen this manner, I imagine Apple inventory is in a “Wave Three” up within the bigger diploma proper now. For anybody who has exterior pursuits, household, mates, pets and many others. and isn’t versed within the lore of Elliot Wave concept, you possibly can consider a Wave Three as essentially the most highly effective transfer of a inventory inside an general bigger development.

While typically decried, the explanation technical evaluation might be helpful is that, used properly, it may well reveal the breadcrumbs left behind by institutional traders as they transfer massive sums of capital across the market. For this, the quantity x value indicator is commonly helpful. On the chart above, you possibly can see this within the grey bars on the right-hand facet of the chart. This exhibits the quantity of buying and selling in any given value zone (every bar is a value zone outlined by the peak of the bar on the y-axis). Time = 0 is about on the current January 2023 bear market low, that means that each one the quantity you see there since that point has taken place in the course of the upswing within the inventory. And what it tells you is that there was an enormous spike in quantity between round $170/share – $197/share.

The information on this format is insufficiently granular to say whether or not this represents institutional shopping for or promoting – so it is essential to make use of one’s judgment on this regard. We rated Apple at Accumulate in that vary as a result of, we imagine, the inventory was being purchased up over time by establishments.

Apple Elementary Evaluation

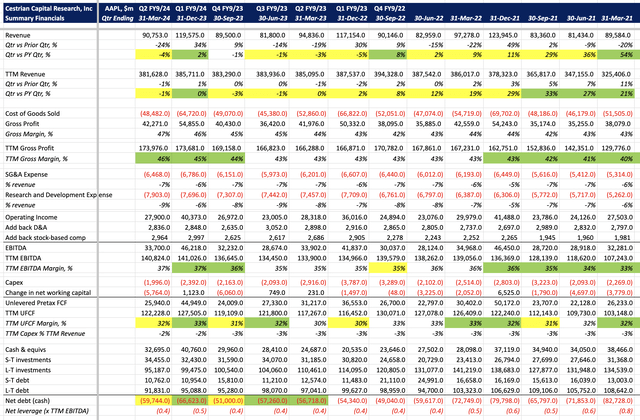

The December 2023 earnings print gave a clue as to why – progress had turned constructive year-on-year for the primary time for the reason that December 2022 quarter.

AAPL Fundamentals (Firm SEC Filings, Cestrian Evaluation, YCharts.com)

The break to the upside got here, after all, with the current product updates centered across the introduction of AI capabilities on the machine – within the case of the iPhone, not backwards-compatible with older variations. So if you need AI, it’s worthwhile to purchase a brand new high-end cellphone, easy. And while we will argue the deserves of this, I believe the actual fact is that many individuals will go purchase the high-end cellphone. And this has led to an ex-post-facto narrative about Apple now being a serious AI on-ramp; which has gotten late bulls all excited in regards to the inventory; which has led to patrons leaping on the breakout and fueling this new rally. This is the sort of factor that drives Wave 3s.

Apple has been deemed an “under-owned” inventory for a while now, as this current Searching for Alpha article explains. The article is from summer season 2023, however current commentary from institutional gross sales desks suggests the title stays under-owned.

Lastly, there stays a wall of cash in money-market funds, as traders have elected to maintain it there incomes greater charges of return than has been out there for money for some years. We are able to debate if and when the Fed will minimize charges; I imagine it would, and I imagine this, plus an ongoing bull market, will attract a considerable sum of recent money from these cash market accounts. By definition, holders shall be of the conservative kind; and if I have been to guess one inventory, they may like to purchase? I’d guess Apple as a result of (1) it is a longtime biggest-company title, (2) the corporate is thought to be well-managed and cautious with capital, (3) the valuation is not foolish even after the breakout, and likewise (4) it is Apple.

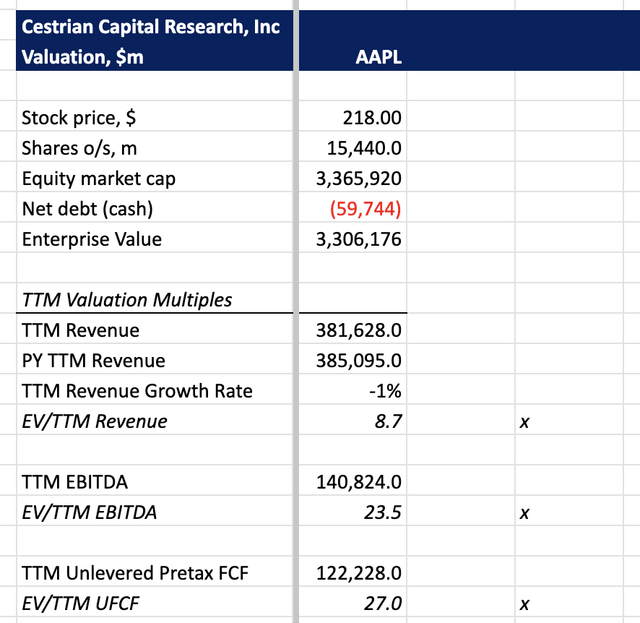

Apple Valuation Evaluation

Here is that valuation, by the way in which. All the time a matter of judgment, after all, however I doubt that 27x TTM unlevered pretax FCF is especially costly for this inventory.

AAPL Valuation Evaluation (Firm SEC filings, YCharts.com, Cestrian Evaluation)

Conclusions, Worth Goal And Ranking

So I imagine situations are ripe for a continued rally within the title.

1 – Technical components recommend it, and while technicals can all the time be improper, when there may be supporting proof from the actual world, one’s perception within the technicals could justifiably rise.

2 – Apple Inc. fundamentals are turning up – I’d be shocked if iPhone gross sales didn’t reply properly to the “it’s important to purchase the costly new one if you need the nice AI” technique.

3 – Institutional traders are probably under-exposed nonetheless, and,

4 – Late-bull retail traders are prone to wish to purchase the title if and when charges drop and money-market accounts grow to be a much less engaging place to park capital.

The 1.618 Wave 3 extension, a standard topping zone, is $328. In order that’s our value goal on the title.

We charge Apple Inc. inventory at Maintain, having been at “Accumulate” between $166-194.

Alex King, Cestrian Capital Analysis, Inc – 17 June 2024.