Apple: Upgrading To Purchase On New Catalyst And Adjusted Smartphone Expectations (AAPL) – Cyber Tech

CasarsaGuru/E+ through Getty Photos

We’re upgrading Apple Inc. (NASDAQ:AAPL) to a purchase after a protracted, impartial stance on the inventory as we see extra upside on two components. First, we predict the market has acknowledged the muted smartphone demand and intensified competitors on the Chinese language entrance, significantly after Apple’s March quarter outcomes, by which iPhone gross sales dropped Y/Y, inflicting a pullback in whole gross sales for the quarter. Second, we predict the corporate is best positioned to reverse its lackluster iPhone gross sales with Apple Intelligence built-in into iOS 18, introduced on the WWDC occasion. Apple Intelligence is supported by the newest iPhones, particularly the iPhone 15, iPhone 15 Professional Max, and M-series iPads and Macs. We predict the primary attraction of Apple Intelligence is that it might incentivize an improve cycle regardless of the macro slowdown, or at the very least enhance gross sales for the new line-up to beat expectations.

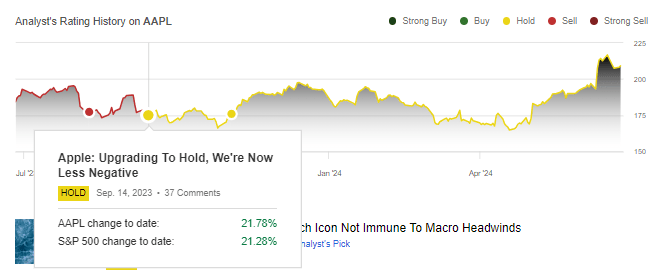

Since our improve to a maintain in September 2023, the inventory has carried out in keeping with the S&P 500; our November thesis performed out. We had said in our November article, “We anticipate the present macro headwinds to proceed weighing on finish demand and see a restricted upside to the corporate’s monetary outperformance within the again finish of the yr and into calendar 1H24.” Avenue expectations of iPhone gross sales have been revised down since January, making expectations low sufficient to assist outperformance in a tough macro backdrop. The more moderen optimism on the inventory is supported by the share buy-back program and the brand new AI options.

We now assume Apple is best positioned to outperform after the negatives have performed out. Apple Intelligence serves as a catalyst for the brand new iPhone launch and offers an edge for the anticipated smartphone TAM progress in 2025.

The next chart outlines our score historical past on Apple.

SeekingAlpha

Our business analysis continues to indicate muted smartphone demand for 2024, however we anticipate a cloth restoration in 2025 because the business can not proceed to maintain itself on present run charges. Administration throughout the semi-peer group additionally confirmed the weak smartphone demand this yr. That is necessary as a result of we imagine this implies demand will backside this yr to recuperate in 2025. Simply final week, Micron (MU) administration famous “solely regular near-term demand in PCs and smartphones.” TSMC (TSM) confirmed this outlook, reporting a smartphone income decline of 16% Y/Y and noting muted progress with the expectation of AI; this issues as a result of Apple is “buyer A” at TSMC and accounted for ~25% of whole gross sales final yr. Skyworks (SWKS), Qualcomm (QCOM), and Qorvo (QRVO), all of which share Apple as their largest buyer, reported weak cell gross sales within the first half of the yr due to weaker demand from Apple. Skyworks reported cell gross sales down 19% Q/Q; Qualcomm reported handset gross sales down 8% Q/Q; Qorvo’s superior mobile group gross sales declined 23% Q/Q. These outcomes inform us that the market acknowledges the weaker demand within the post-inventory correction surroundings. We like Apple’s odds within the second half of the yr and 1H25, as excessive expectations have been re-adjusted within the first half of the yr.

Wanting ahead, IDC forecasts international smartphone shipments to develop low single digits at ~4% this yr; we predict there will likely be a gradual restoration within the again finish of the yr earlier than a true-end demand restoration in 2025. We all know thus far that within the first quarter of CY2024, smartphone shipments grew ~6% Y/Y, and we’re nonetheless ready on the second quarter numbers. We’re extra constructive about Apple’s new iPhone lineup gross sales in 2H24 as a result of the corporate has given us a catalyst: Apple Intelligence.

The corporate is branding Apple Intelligence as “AI for the remainder of us,” partnering with OpenAI’s ChatGPT. AI options will likely be integrated into iOS 18, iPadOS 18, and MacOS sequoia. Apple Intelligence will enable using ChatGPT to generate customized solutions utilizing pictures and textual content for the consumer by way of entry to non-public information (calendar, mail, and so forth.). The improve will profit Siri because it’ll even be tapped into ChatGPT. It is necessary to consider the enhancements that’ll come to Siri with this improve as a result of Siri might doubtlessly serve as a substitute search engine for customers.

Nonetheless, we anticipate Apple Intelligence may have its hurdles alongside the way in which; we have already seen this with the constraints of use relying on the Apple product, necessitating an improve cycle for mass adoption. This might be tougher within the present financial backdrop, however is achievable for 2025 because the Fed forecasts a minimize this yr that ought to assist with macro restoration subsequent yr. There are additionally considerations over entry to options of Apple Intelligence being blocked as a result of EU’s Digital Markets Act or DMA laws; evidently the laws “might pressure us [Apple] to compromise the integrity of our merchandise in ways in which danger consumer privateness and information safety” based on an announcement from the corporate. It is nonetheless unclear if Apple Intelligence will likely be accessible to EU customers when it goes dwell this Fall. Our constructive outlook on Apple Intelligence is longer-term, and we do not assume the regulatory considerations would stick for 2025 with out decision. It is also not Apple’s first rodeo with regulatory scrutiny.

The China query

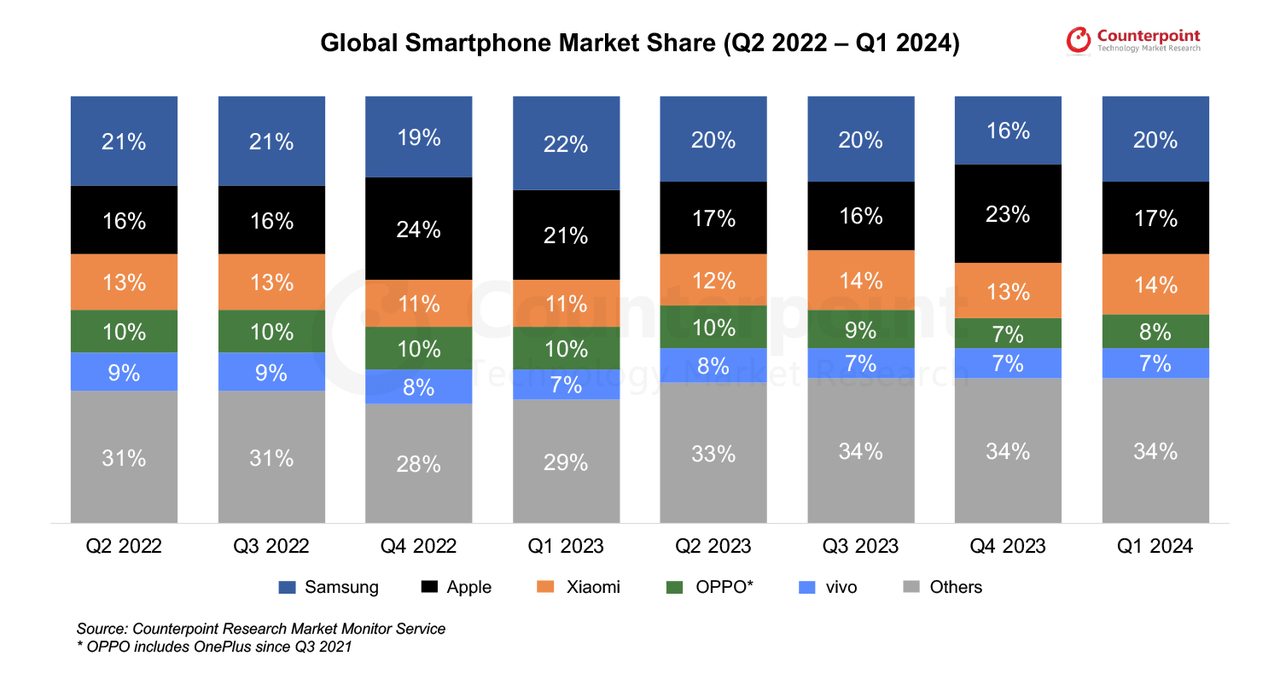

The previous three quarters reminded us that Apple’s top-line progress is extremely reliant on iPhone gross sales, which makes the inventory extra uncovered to China than most of us would have appreciated. China stays the world’s largest smartphone market. In late 2022, that publicity confirmed up on the manufacturing aspect of Apple’s enterprise, with the biggest iPhone meeting manufacturing unit shutting down on protests and Zero COVID restrictions, inflicting a slowdown in manufacturing. In 2H23 and 1H24, the corporate’s publicity to China is seen within the iPhone gross sales slowdown, as 1. The broader smartphone business skilled a slowdown in demand, and a couple of. Competitors from Huawei and Samsung intensifies, with the previous gaining extra floor within the Chinese language market. Apple misplaced its standing because the world’s largest smartphone supplier within the first quarter, with 20% of the worldwide market, to Samsung early this yr after the pullback in shipments, as proven beneath. We’re not as involved about publicity to China as we have been in 2H23, and the reason being that the corporate’s vulnerability to China has been priced into the inventory and investor expectations.

Counterpoint

Valuation & phrase on Wall Avenue

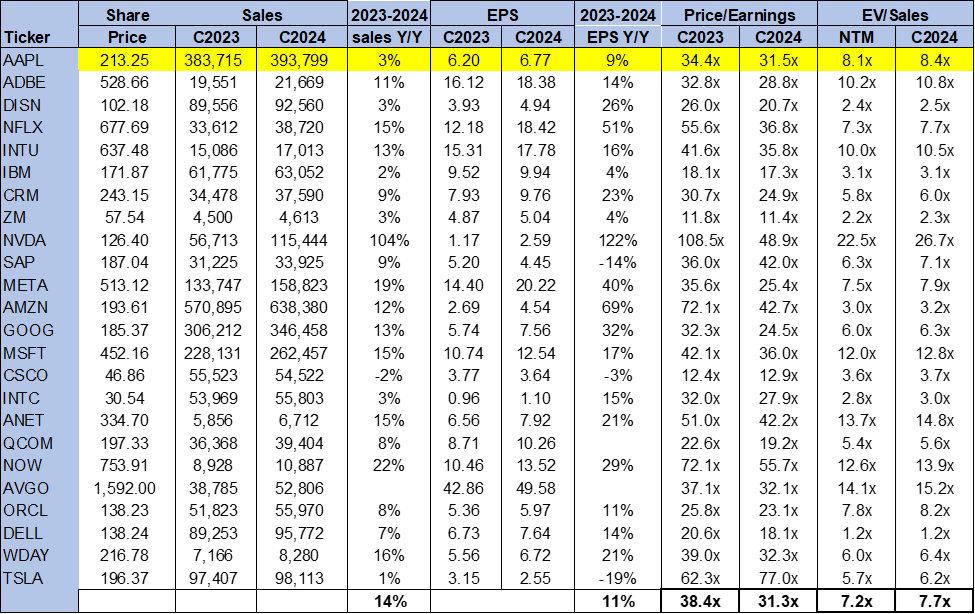

The inventory is buying and selling above its large-cap peer group common, regardless of this, we predict Apple is pretty valued at present ranges. The upper a number of is justified by the corporate’s place within the smartphone business, in time for its anticipated restoration in 2025 and Apple Intelligence tailwinds. On a P/E foundation, the inventory is buying and selling at 31.5x C2024 EPS $6.77 in comparison with the peer group common of 31.3x. The inventory is buying and selling at 8.4x EV/C2024 Gross sales, versus the peer group common of 5.6x. We perceive buyers’ concern in regards to the continued competitors on the smartphone entrance, however we imagine iOS 18 will present a aggressive edge for the iPhone in opposition to the competitors in China. We imagine the upper valuation may be justified by Apple’s mid to long-term secular progress tailwinds for its iPhone gross sales because the smartphone TAM expands and repair enterprise progress. The latter just isn’t solely the corporate’s fastest-growing enterprise however probably the most worthwhile one.

The next chart outlines Apple’s valuation in opposition to the peer group common.

TechStockPros

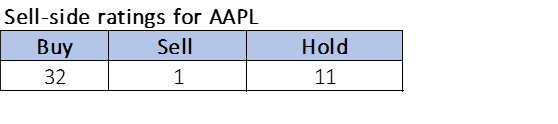

Wall Avenue shares our constructive sentiment on the inventory. Of the 44 analysts protecting the inventory, 32 are buy-rated, 11 are hold-rated, and the remaining are sell-rated. Wall Avenue has been extra constructive on the inventory although the smartphone downturn in 1H24, however we have seen extra of the negatives be digested over the previous two quarters with downward revisions for consensus expectations. A part of our improve relies on our perception that expectations are manageable sufficient to assist one other beat.

The inventory is at present priced at $214 per share. The median sell-side worth goal is $210, whereas $212 is the sell-side imply goal, with a possible upside of -1% to -2%. The next charts define Apple’s sell-side scores.

TechStockPros

What to do with the inventory?

We’re transferring Apple to a purchase. We predict the inventory has extra upside on investor confidence in Apple Intelligence and administration’s go-to technique to monetize it by way of iOS18. We’re additionally monitoring Apple’s service enterprise. Some anticipate Apple’s “shift to a service enterprise mannequin is a strong method to compensate for its dependence on iPhone gross sales efficiency.” We agree with this assertion. With the arrival of Apple Intelligence, we predict there’s extra potential for providers as administration clearly fills the hole between itself and different large-cap gamers specializing in AI monetization, i.e., Microsoft (MSFT) and Google (GOOGL), amongst others. The principle query is the place the adoption of Apple Intelligence and the rebound in smartphone demand will overlap; we see this taking place in 2025 and would suggest buyers bounce into the inventory as we predict Apple can outperform the S&P 500 into 2025.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.