Apple: Robust Earnings Anticipated, Secular Challenges Persist (NASDAQ:AAPL) – Cyber Tech

SL/iStock Editorial through Getty Photos

My thesis

Apple Inc. (NASDAQ:AAPL) is releasing its fiscal Q3 earnings this week and there are a number of stable indicators that the corporate will ship a constructive shock as soon as once more because the world smartphone and PC markets are recovering and gaining momentum. Furthermore, the Companies pricing energy will even possible help the EPS progress. That’s the predominant motive why I nonetheless suppose that AAPL is a Maintain.

Nonetheless, I’m contemplating trimming and even closing my AAPL place within the upcoming quarters as a result of the corporate’s present $3.3 trillion market cap is a method too beneficiant valuation for an organization that has a large iPhone focus danger. Not one of the firm’s new merchandise launched after its flagman is shut when it comes to income. Furthermore, I consider that merchandise just like the iPad and Mac overlap with one another, particularly after the latest launch of the brand-new iPad Professional with its revolutionary M4 chip.

AAPL inventory evaluation

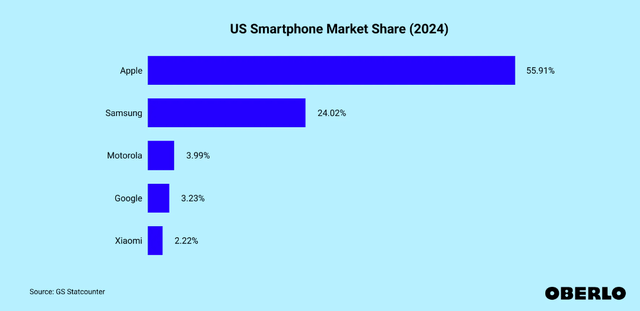

In response to Oberlo, Apple dominates the U.S. smartphone market with a 56% market share. Apple is presently not main within the world smartphone market, however its share in Q1 2024 was nonetheless notable at 17.3%. The corporate’s flagship iPhone has been dominating the business for years, and its new releases are nonetheless among the many most desired Christmas items.

Oberlo

Apple’s model energy is unparalleled, for my part. The iPhone 15 doesn’t look like fully distinctive in comparison with its earlier technology mannequin, the iPhone 14. Nonetheless, individuals are nonetheless able to pay round $1,000 to get the brand new mannequin, and it’s common that there are huge queues to get one in numerous Apple Shops internationally. Every presentation of a brand new iPhone is an enormous occasion which is watched dwell by thousands and thousands of customers worldwide. I take into account such a long-lasting iPhone mania to be the corporate’s obvious elementary energy.

Other than a large real model loyalty, Apple has created an ecosystem of companies and subscriptions, which additionally will increase switching prices for patrons. Furthermore, for an individual who pairs the iPhone with the corporate’s different gadgets just like the iPad, or the Apple Watch, will probably be troublesome to purchase an Android-based smartphone as a substitute. The mixing with companies like iCloud creates even a stronger bond, based mostly on my private expertise. An ecosystem blended with a large model loyalty helps the corporate to drive additional progress.

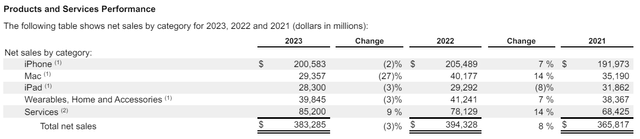

For instance, iPhone gross sales have been about flat just lately, with delicate or no progress. That is defined not solely by the document inflation and rates of interest just lately, but in addition by the intensifying competitors. The corporate is struggling in China, one of many world’s most vital markets for any firm, and I take into account it as a elementary danger. Nonetheless, the corporate drove consolidated earnings progress with its Companies. There have been huge subscription value will increase for companies just like the iCloud and Apple TV. I’m removed from being an individual who is able to keep in queues to be one of many first who will get the brand new mannequin. Nonetheless, I don’t think about how I can change to Samsung or Huawei, even when the corporate makes the iCloud subscription 5 occasions pricier.

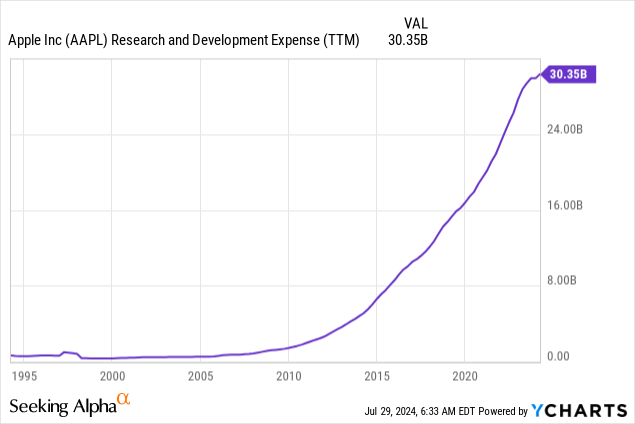

The iPhone’s market place is undamaged, and its stellar ecosystem will assist in boosting earnings, even when the competitors within the smartphone business continues intensifying. Furthermore, the corporate’s dedication to develop its merchandise is undisputable, which I see from Apple’s exponentially rising R&D spending.

However, for a $3.3 trillion firm, counting on a sole revenue’s progress driver is likely to be inadequate from the longer-term perspective. Each product has its life cycle, and the iPhone that was first launched in 2007 appears like a “veteran” in our fast-paced world. It’s troublesome to foretell ten years from now, however the state of affairs the place the iPhone is disrupted by a brand-new communication means doesn’t look unrealistic to me.

Apple has launched a great deal of completely different merchandise after the primary iPhone, however none of those new merchandise turned even near the flagman when it comes to income figures. The corporate has just lately launched its brand-new iPad Professional with a revolutionary AI Chip, and that is nice. However, this pill with a large computing energy creates competitors with the corporate’s Mac. I don’t see the necessity for an individual to have each merchandise in the event that they ship roughly the identical efficiency and remedy issues which overlap.

The corporate’s newest huge new product was its Imaginative and prescient Professional VR headset launched a number of months in the past, which didn’t promote out on its launch date, which is uncommon for Apple’s merchandise. The headset begins at $3,499, round 3.5 occasions pricier than the typical iPhone. In response to the supply, the corporate expects to promote round 450,000 models in 2024. This implies a complete of round $1.6 billion income from the product in 2024, which is insignificant relative to the corporate’s scale. To match no less than the iPad’s income, Apple must promote round 8.1 million Imaginative and prescient Professional models per yr. Due to this fact, the uncertainty round this product remains to be very excessive, and I might not danger mentioning it as a possible constructive long-term catalyst for the corporate.

10-Ok of AAPL

Essentially the most vital upcoming catalyst that I see for Apple is its nearest earnings launch deliberate for August 1, post-market. The final time Apple missed consensus EPS estimates was the December 2022 quarter. Regardless of fiscal Q3 income progress is anticipated to be modest once more at 2.8% YoY, Wall Road analysts count on the EPS to develop by 5.9%. I feel that progress in Companies income will as soon as once more would be the main EPS progress driver, as in a number of earlier quarters.

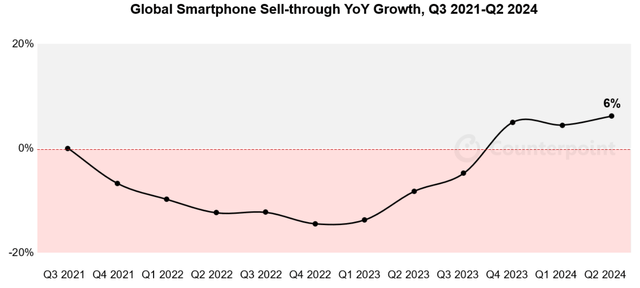

There are a number of necessary indicators that the corporate is prone to ship robust outcomes in opposition to consensus forecasts. Since greater than half of Apple’s gross sales are generated by the iPhone, it’s vital to notice that the worldwide smartphone market grew by 6% YoY in Q2 2024, which is the very best YoY quarterly progress during the last three years. The worldwide PC market additionally demonstrated progress in Q2 2024, which is one other constructive signal earlier than the corporate’s earnings.

counterpointresearch.com

To conclude, I’m optimistic concerning the firm’s upcoming earnings launch, as there are quite a few bullish indicators. Furthermore, the inventory rallied massively after the earlier earnings launch, that means that the corporate can nonetheless shock traders.

However, my opinion from the secular perspective is blended. The iPhone’s present market positioning is undamaged, and Apple’s potential to drive additional EPS progress with solely exercising pricing energy in Companies appears actual. Nonetheless, Apple seems to be counting on its flagman an excessive amount of for a $3.3 trillion greenback firm. It seems that the corporate doesn’t produce other notable progress profitability drivers aside from Companies. None of its merchandise are near the iPhone’s scale, and a few of them look like competing.

Intrinsic worth calculation

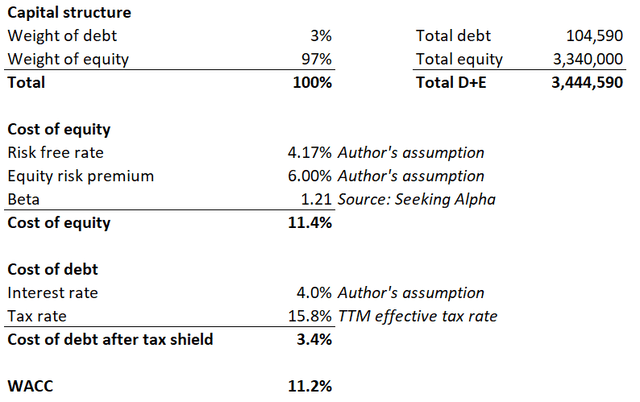

The low cost fee is an important assumption for the discounted money movement (DCF) mannequin. Due to this fact, I begin with calculating the weighted common price of capital (WACC) utilizing the capital-asset pricing mannequin (CAPM). Under working outlines my WACC calculations. AAPL’s WACC is 11.2%.

DT Make investments

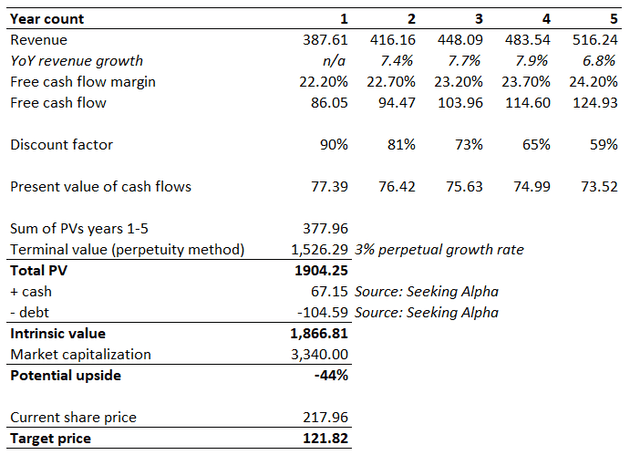

Consensus estimates seem conservative, as they observe a mid-single digit income CAGR for the subsequent 5 years. A 22.2% TTM levered FCF margin is projected for yr 1. Since Apple has been traditionally robust in increasing its profitability ratios, I mission a 50 foundation factors yearly enlargement in FCF margin. Since Apple confronts the legislation of huge numbers, it’s troublesome for me to include perpetual progress fee larger than inflation ranges. Due to this fact, the perpetual progress fee might be truthful at 3%.

DT Make investments

With conservative income progress assumptions, the corporate’s intrinsic worth is method under its present market capitalization. There’s round 44% draw back potential, based on the above working.

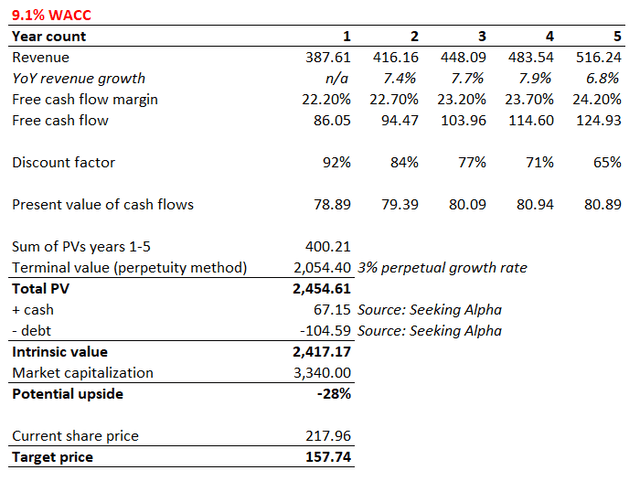

An 11.2% WACC is likely to be too aggressive for an organization like AAPL, particularly in mild of anticipated rates of interest cuts by the Fed in late 2024 and thru 2025. Reducing the risk-free fee to 2% in my CAPM mannequin softens WACC to 9.1%. Nonetheless, even with a notably decrease low cost fee, the intrinsic worth remains to be 28% under the present market cap.

DT Make investments

What can go flawed with my thesis?

My thesis is blended as a result of I feel that recommending promoting the inventory might be unfair whereas I’m the proprietor of the inventory and a number of Apple merchandise. However, it seems that unrealistic optimism is included into the share value. Due to this fact, I don’t advocate shopping for the inventory on the present value and if the inventory rallies additional it’ll imply that my thesis went flawed.

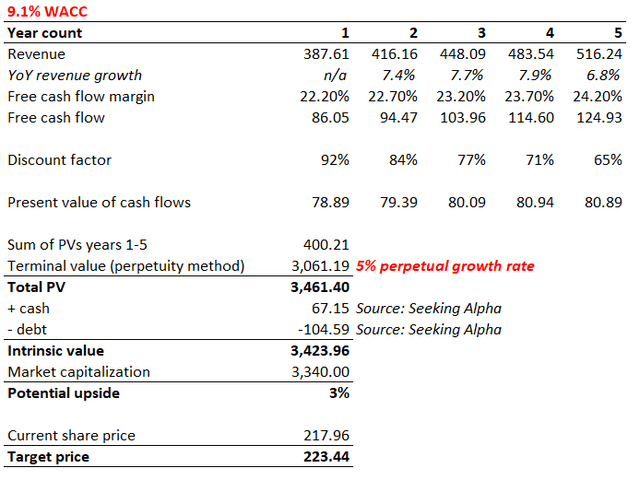

The present market capitalization is justified if a 5% perpetual progress fee is included. Whereas such a perpetual progress fee doesn’t look unrealistic on the whole, I feel that the chance of Apple delivering such a progress fee is kind of low. The corporate is anticipated to surpass a half-a-trillion income milestone by the tip of 2020s. Delivering progress might be very onerous in opposition to huge quantities, particularly contemplating some elementary challenges that I’ve described earlier in my evaluation.

DT Make investments

Abstract

I proceed to Maintain my Apple Inc. place as a result of I count on the corporate to ship a robust earnings report this week, which can possible help the share value even regardless of the present huge overvaluation. Nonetheless, as a consequence of secular dangers that I’ve described, I feel that I’ll get thinking about trimming my place later this yr.