Apple Inventory: Continues To Lose Smartphone Market Share (NASDAQ:AAPL) – Cyber Tech

ozgurdonmaz

Funding thesis

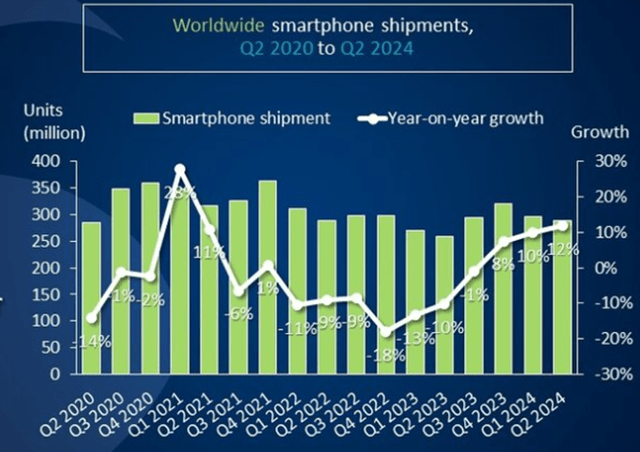

Demand within the international market of gadgets continued to bounce again. Apple (NASDAQ:AAPL) (AAPL:CA) bought 45.6 mln smartphones (+6% y/y) in 3Q 2024, whereas the full smartphone market climbed by 12% y/y to 288.9 mln models. Apple’s share of the smartphone market shrank to 16%, down 1 pp from a yr earlier. Falling gross sales in China had been compensated by rising gross sales in India. However within the Indian market, iPhone is taken into account an costly model, so the compensation induced the typical income per buyer to drop to ~$860 (-7% y/y).

Final quarter, as we wrote in our earlier article, Apple additionally misplaced share within the smartphone market: in Q2 2024, Apple Inc. bought 48.7 million smartphones (-16% YoY), whereas the full smartphone market grew by 10% YoY to 296 million models. The ranking is HOLD.

Smartphone market

Complete smartphone shipments climbed by 12% y/y to 288.9 mln models in 2Q 2024 (3Q 2024 for Apple).

Canalys

Apple’s gross sales totaled 45.6 mln smartphones (+6% y/y), and Apple’s share of the smartphone market shrank to 16% from 17% in 2Q 2023 (3Q 2023 for Apple).

Creating international locations in Asia, Latin America, Africa and the Center East proceed to be the primary progress driver for the smartphone market. Bodily gross sales there expanded by 10% to twenty% y/y in 2Q 2024. Nonetheless, by way of cash, the primary markets for Apple are the US, China and Europe. Complete smartphone gross sales climbed by 5% y/y within the US, 14% y/y in Europe, and 6% y/y in China. Even so, Apple continued to lose market share in China, yielding it to native producers. Apple’s market share in China fell to fifteen.5% from 17.4% a yr earlier, whereas bodily gross sales declined by 6%.

Luxurious smartphone manufacturers – Apple and Samsung – are being helped by the market restoration within the US and Europe, as outdated inventories have been bought out and shops have began to vigorously rebuild them earlier than the brand new vacation season. Within the second half of 2024, main manufacturers might be seeking to ramp up shipments of smartphones which have GenAI onboard. Within the close to future, this would be the predominant issue that can affect gross sales of any explicit model.

At a developer convention, Apple unveiled its personal Apple Intelligence, which it plans to embed into smartphones and Siri to enhance understanding of pure language. As well as, Apple entered right into a partnership with OpenAI and can embed ChatGPT into its gadgets. Based on insiders, the partnership with OpenAI just isn’t for revenue, that means that Apple is not going to pay OpenAI for utilizing ChatGPT. As an alternative of cost, OpenAI will get entry to Apple’s giant buyer base and can probably promote them mini-apps which are embedded in ChatGPT – transactions for which Apple will earn a 30% fee.

We anticipate that Apple, by integrating with OpenAI, will regain market share extra rapidly, particularly within the US and EU. In developed international locations, Apple competes primarily with Samsung, whose AI is weaker than ChatGPT. Apple is not going to have this benefit within the Chinese language market, the place the US tech large will use Baidu’s AI, which ranges the taking part in discipline for native suppliers.

We’re additionally seeing client spending within the US and Europe really exceeding disposable revenue, which is progressively depleting built-up financial savings and squeezing demand for sturdy items.

Consequently, regardless of the fast market restoration within the first half of the yr, we’re sustaining our forecast for smartphone shipments for the total yr of 2024 at 1.2 bln models (+5% y/y) and at 1.26 bln models (+5% y/y) for 2025.

Contemplating the mixing between Apple and OpenAI, we’re elevating the forecast for iPhone’s market share from 19% (-0.9 pp) to 19.6% (-0.3 pp) for 2024, and from 19.3% (+0.3 pp) to 21.1% (+1.5 pp) for 2025.

Falling gross sales in China had been compensated by rising gross sales in India. However within the Indian market, iPhone is taken into account an costly model, so the compensation induced the typical income per buyer to drop to ~$860 (-7% y/y).

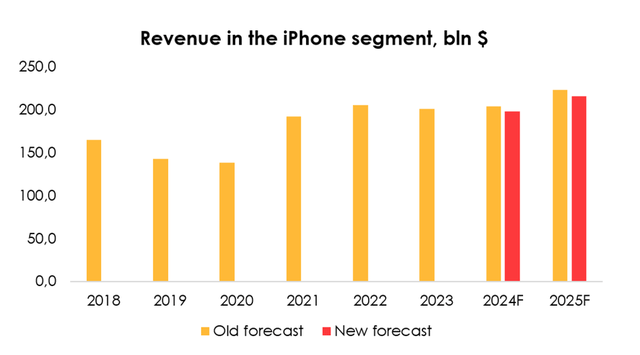

Consequently, we’re decreasing the projected common income per one iPhone from $935 (+3% y/y) to $886 (-2% y/y) for 2024, and from $982 (+5% y/y) to $884 (-0.2% y/y) for 2025.

Given all of the modifications, we’re slicing the forecast for Apple’s income from $203.6 bln (+1% y/y) to $198 bln (-1% y/y) for 2024, and from $223 bln (+10% y/y) to $215.6 bln (+9% y/y) for 2025.

Make investments Heroes

Apple’s different segments

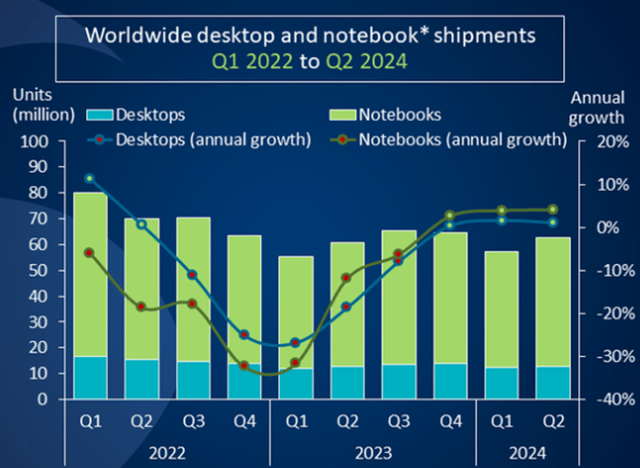

The Mac section delivers steady monetary outcomes. Income within the section totaled $7 bln (+2% y/y). The corporate bought 5.5 mln Macs, up 6% from a yr earlier. Common income per gadget slid by 2% y/y. Apple’s market share within the PC section edged up barely to eight.8% (+0.2 pp y/y). The worldwide PC market continued to rebound at a average tempo. Complete PC shipments climbed by 3.4% y/y to 62.8 mln models.

Canalys

The iPad section began to recuperate quickly. Income within the section totaled $7.2 bln (+24% y/y). We attribute this to the discharge of the brand new iPad 2024 in Could 2024. The brand new model of the iPad is much superior to earlier variations and is powered by the revolutionary M4 chip. The pill additionally accommodates an NPU Neural Engine, making it appropriate for widespread use of AI apps.

Income from wearable gadgets, which embrace Apple Imaginative and prescient Professional, totaled $8.1 bln, down 2% y/y. Apple faces quickly growing competitors within the smartwatch and wi-fi headphone market from Chinese language rivals and the Nothing model, which have improved loads by way of know-how and design over the previous yr.

The corporate plans to promote the Imaginative and prescient Professional in 8 extra international locations, together with China and Japan. A brand new OS – VisionOS2 – has been introduced for the Imaginative and prescient Professional. It’s going to use machine studying for creating spatial photographs and have new hand gestures. In the meanwhile, Apple Imaginative and prescient Professional might be described as an experimental mannequin, which pulls demand primarily from corporations which are making an attempt to check it and adapt it to their very own wants.

The corporate’s providers income got here in at $24.2 bln, up 14% from a yr earlier.

Apple’s monetary outcomes

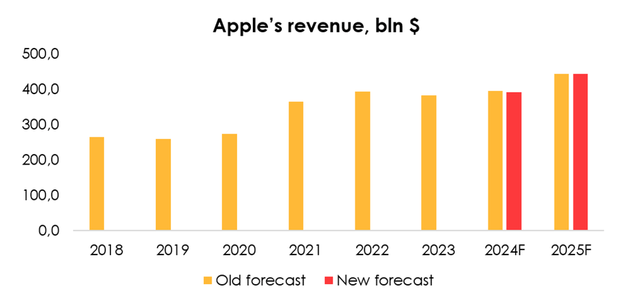

We’re decreasing the forecast for Apple’s income from $395.6 bln (+3% y/y) to $391.3 bln (+2% y/y) for 2024, and from $444.7 bln (+12% y/y) to $443.8 bln (+13% y/y) for 2025 on account of expectations of weaker smartphone gross sales, although that’s partially mitigated by larger forecasts for gross sales within the iPad and providers segments.

Make investments Heroes

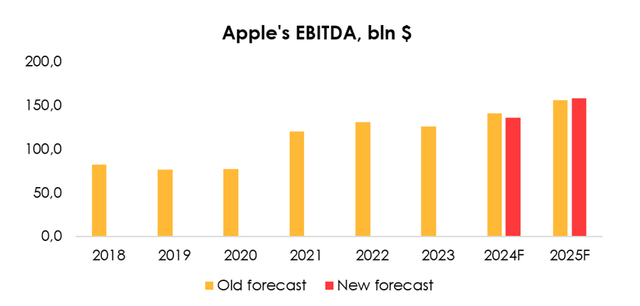

We’re decreasing the EBITDA forecast from $140.7 bln (+12% y/y) to $135.5 bln (+8% y/y) for 2024 because of the decreased income forecast and better prices of elements for the corporate’s gadgets and barely elevating it from $155.8 bln (+15% y/y) to $157.7 bln (+16% y/y) for 2025 on account of fast progress in Apple’s marginal providers section, which is able to offset the discount within the firm’s gadget income forecast.

Make investments Heroes

Valuation

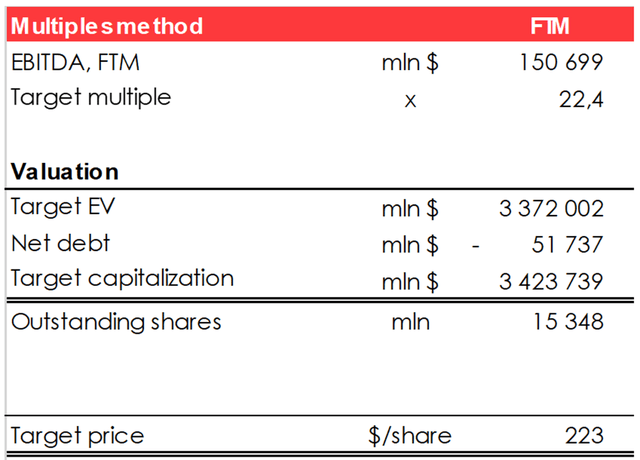

We’re elevating the goal value of the shares from $171 to $223 on account of:

- the rise within the goal a number of for Apple from 17.5x to 22.4x;

- the decreased EBITDA forecast for 2024 and 2025;

- the rise of web debt from ($58) to ($52) bln;

- the lower of the variety of diluted excellent shares from 15.5 bln to fifteen.4 bln;

- the shift of the FTM valuation interval.

We’re assigning a HOLD ranking to the inventory.

Make investments Heroes

Conclusion

Apple is a high-tech firm that’s busy growing its personal ecosystem. Nonetheless, the latest developments within the smartphone market considerably restrict its progress potential. We consider the corporate is buying and selling near honest worth. The ranking is HOLD.

To handle your positions, we suggest following Apple’s earnings releases and market updates.