Apple: Possibilities Of AI Success (NASDAQ:AAPL) – Cyber Tech

Ivan-balvan

Funding Thesis

My iPhone X, which I bought in 2017 when Apple (NASDAQ:AAPL) (NEOE:AAPL:CA) first rolled out the face recognition characteristic, has been with me by means of thick and skinny. I did change a damaged display a couple of instances, and at one level, my insurance coverage bought me a alternative; a refurbished iPhone X, however because of the magic of iCloud, it stored its essence, sustaining the settings, apps, pictures, paperwork, and many others. of the unique iPhone.

I just lately discovered that the iPhone X will not help the brand new Apple Intelligence options, which is able to most certainly imply that I’ll half methods with my trusty iPhone X. My cellular service has been making an attempt to hook me up for a brand new iPhone for a while now (with a compelling low cost I ought to add), and I believe I am going to lastly take them on that provide.

The iPhone’s sturdiness, mixed with Apple’s constant iOS updates, has created a big base of older fashions customers. Apple Intelligence’s rollout could possibly be a catalyst for a lot of of those clients, together with myself, to improve their units, probably creating one of many largest gross sales Supercycles within the firm’s historical past. This, together with Apple’s robust model loyalty and rising service income, reinforces our purchase score.

FQ2 2024 iPhone Gross sales Decline

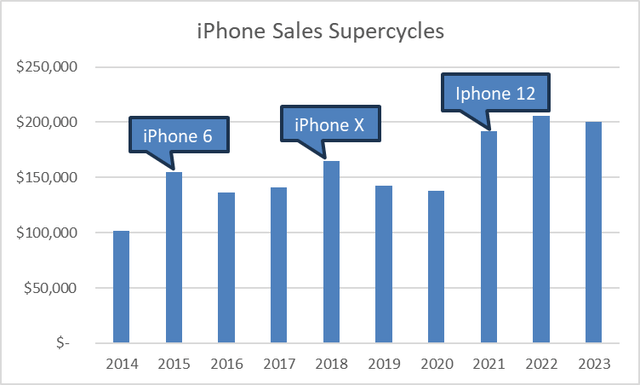

iPhone’s success partly hinges on what is called Supercycles, a interval of speedy gross sales progress triggered by vital product improvements. These Supercycles sometimes spark a wave of upgrades, adopted by a return to extra normalized demand. The iPhone X launch was one such Supercycle, because of the face recognition characteristic and design overhaul. iPhone 6 additionally introduced wider screens that created a surge in iPhone upgrades. One of the strong Supercycles was the iPhone 12, the primary to help 5G.

In current quarters, Apple iPhone gross sales declined, drawing criticism from some fellow analysts. In Q2 2024 (three months ended March 2024), iPhone gross sales have been down 10%. Nonetheless, when zooming out and looking out on the larger image, one rapidly realizes that this decline comes on the heels of a very strong 2023, fueled by the prolonged iPhone 12 Supercycle, as proven within the chart under.

iPhone Supercycles (SEC filings. Chart created by the writer.)

Valuation

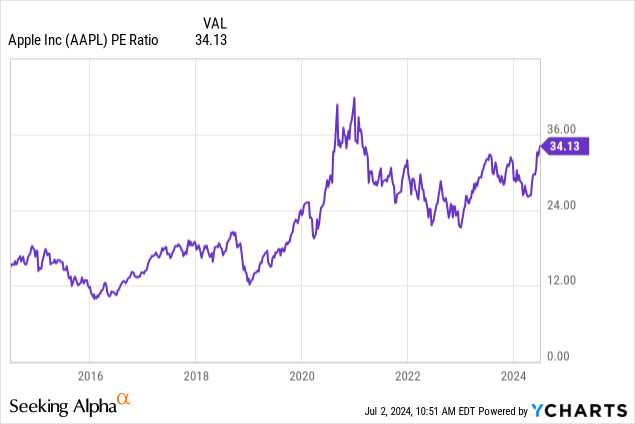

Apple’s PE ratio now stands at 34x, far exceeding its pre-pandemic valuation common of 15x. This vital improve has drawn criticism from many fellow analysts, who raised considerations in regards to the sustainability of such a excessive a number of, particularly in mild of the iPhone’s gross sales cyclicality.

My view is that Apple’s present valuation higher displays its fundamentals, and that earlier valuations at 15x PE have merely underestimated the corporate’s price. One must also be aware that on the time, companies income wasn’t large enough to affect valuation, versus right this moment, the place companies are rising to be probably the most necessary sources of earnings. Additionally it is potential that previously, the market positioned a reduction on Apple’s shares as a result of there was merely not sufficient information to foretell iPhone improve cycles.

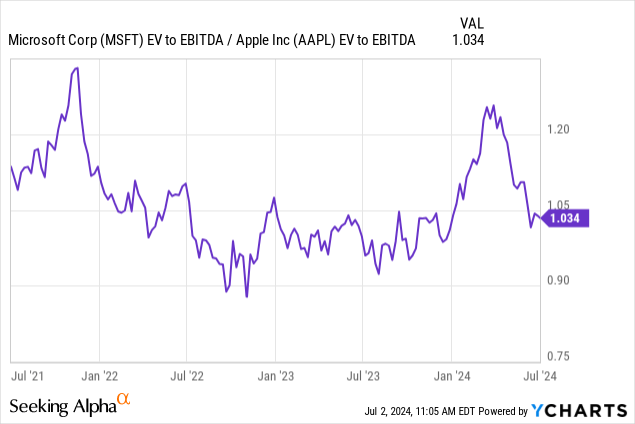

When it comes to relative valuation, when Apple’s valuation in comparison with Microsoft (MSFT), we truly see that it stays near historic averages.

I simply cannot think about Apple buying and selling at 15x value multiples, particularly when how briskly its companies income is rising and the chance poised by Apple Intelligence to spice up the capabilities of our telephones, integrating them additional into our lives.

Companies Income

Apple is not nearly iPhones anymore. The companies they provide, like Apple Music, Apple TV, and iCloud, have gotten big money-makers. These companies made up a whopping 42% of Apple’s whole gross earnings final quarter.

With Apple diving into AI, the corporate’s service income potential is larger than ever. The brand new iOS might be launched later this yr, and whereas nobody will be positive precisely what the brand new working system will seem like, or its capabilities and options, it is simple to think about Apple making some huge cash from it.

For instance, just like Samsung (OTCPK:SSNLF), Apple can probably create a chatbot that interprets calls in real-time, permitting customers with totally different languages to speak every in their very own language, with a real-time transcript of the decision exhibiting on the display, however with rather more higher accuracy than Samsung. They may provide some primary options totally free, however cost for limitless use, or further options.

The obvious option to monetize AI is by processing subscription charges of ChatGPT or Google’s (GOOG) Gemini purchases made on its units. With a sturdy developer neighborhood constructing Apps for the iOS working system, and now for Apple Intelligence, the potential is simply too huge to disregard.

How I May Be Fallacious: Rising R&D Bills

Apple’s Imaginative and prescient Professional hasn’t loved the spectacular industrial success many hoped for, failing to reinvigorate the Wearables and House Equipment phase gross sales progress. Nonetheless, in absolute phrases, the comparatively constant gross sales ranges level to a gradual improve in market penetration. Each greenback in gross sales means a brand new Apple Watch buyer or a brand new Apple TV system put in.

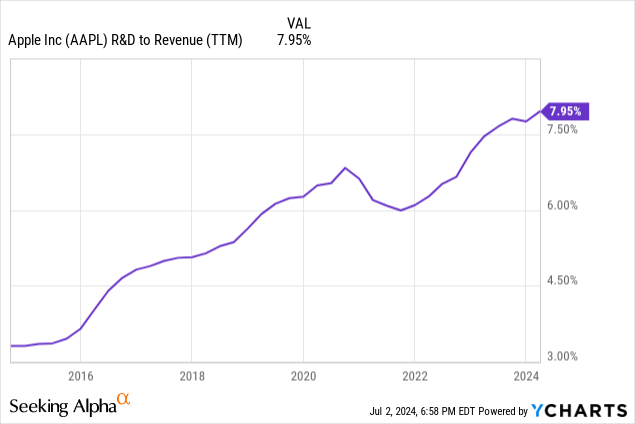

Some analysts are notably essential of Apple’s Imaginative and prescient Professional, highlighting the influence of R&D on profitability, drawing parallels with Meta (META) Oculus VR phase, and the related R&D necessities. Previously ten years, Apple’s R&D bills as a proportion of income have elevated constantly. So there are some deserves to this argument. Then again, I imagine that this effort will ultimately repay. VR is an increasing market, and arguably an important phase within the client electronics business. With larger volumes, these R&D bills will profit from economies of scale. In any case, what’s Apple if not a market innovator of the merchandise of the longer term?

Abstract

Apple has been dealing with a whole lot of criticism from fellow analysts these days. One frequent criticism is that Apple is simply catching up with MSFT and Google concerning AI. I agree that Apple dodged a bullet, however I do not imagine they’re enjoying catch-up. Apple already has the AI infrastructure that allowed it to rapidly roll out Apple Intelligence. On the identical time, if it wasn’t for the truth that OpenAI is impartial of MSFT and that it has an altruistic mission to democratize the expertise at low costs for the good thing about humanity and as accessible to every particular person as is feasible, Apple would not have had the chance to have entry to the cutting-edge tech that energy Apple Intelligence. I believe the current AI developments will lengthen the lead of first-tier smartphones.

The current decline in iPhone gross sales has additionally been some extent of rivalry. Nonetheless, when trying on the larger image, the decline follows a interval of remarkable progress. iPhone gross sales will all the time fluctuate with the rollout of recent iPhone improvements.

The rise in Apple’s PE ratio to 33x from its pre-pandemic common of 15x has been one of many strongest arguments towards Apple. But, I imagine this present valuation extra precisely displays the corporate’s fundamentals and the prior valuation is solely an underestimate. I am unable to think about Apple now buying and selling at 15x PE ratios. On a relative-value foundation, Apple’s relative EV/EBITDA multiples to MSFT’s are near historic common.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.