Apple: AI Technique To Assist Combat DOJ, Kickstart Progress (NASDAQ:AAPL) – Cyber Tech

Justin Sullivan

Funding Thesis

For my part, Apple (NASDAQ:AAPL) has had a tough patch. In latest months, the iPhone maker has taken a success partly on account of the iPhone big smartphone gross sales in China dropping 24% yr over yr, whereas gross sales from considered one of their opponents, Huawei grew by 64% indicating market saturation and doubtlessly plateauing demand for one of many firm’s flagship merchandise.

Elsewhere, in Europe, the corporate is dealing with regulatory motion on their App retailer, forcing the corporate to open up their tech merchandise to direct internet downloads for apps, permitting customers and app suppliers to bypass the App retailer and the as much as 30% income lower Apple will get from app retailer gross sales. This disrupts considered one of Apple’s most profitable divisions. Within the US, the US Division of Justice sued Apple final week, claiming they’re a monopoly in a few of its practices. Ouch.

Nonetheless, as Apple has been at a number of “make or break” junctures in its lifetime, and has prevailed every time earlier than. I imagine this time shall be no totally different, organising what might be a robust shopping for alternative.

For my part, the know-how big might be in for an excellent cycle based mostly on their anticipated integration of superior AI into their product lineup. This integration, I imagine, will truly assist the corporate combat new regulatory pushes each in the USA and Europe and assist counter iPhone sale points in China.

Utilizing know-how comparable to via partnerships with main LLM makers comparable to Google (GOOGL) and Baidu (BIDU), and the expectation of a serious improve with iOS 18, Apple positions themselves to speed up market share and foster progress. These developments might lead Apple to see a bigger improve cycle, resembling a “tremendous cycle.”

As with all thesis, it is not clear lower. The corporate faces antitrust challenges with the DOJ within the US and regulatory motion within the EU. Regardless of this, I stay bullish. I feel the corporate continues to be a robust market chief within the smartphone {industry} and I anticipate them to proceed to guide sooner or later. I feel the inventory continues to be a robust purchase.

Right here’s Why Apple Wants Protection Now

Traditionally, Apple strikes in silence. What I imply by that is that they don’t appear to boast about their early stage technological developments. Contemplating how fast-paced and influential the AI sector is, it’s essential that any doable developments are identified to buyers. The discharge of Chat-GPT awoke the gamers within the tech {industry}; everybody has been racing to turn out to be the main determine in AI. Contemplating Apple’s stronghold within the iPhone and pc market, it’s been suspicious that they haven’t publicly joined in on this race. Nonetheless, that is additionally in keeping with what Tim Prepare dinner, Apple’s CEO stated on their final name:

Our MO, if you’ll, has at all times been to do work after which speak about work and to not get out in entrance of ourselves. -FY 2024 Q1 Name.

Since my last report final December on Apple, the inventory is down 12.01% whereas the market is up 10.51%. I imagine that is largely attributable to considerations I discussed in my funding thesis part round slowing demand in China and regulatory actions within the US & Europe.

Background

In 2011 Apple launched Siri of their iPhone 4S, making a “supercycle” that considerably boosted gross sales and client curiosity. This was considered one of Apple’s first integrations of AI into their iPhones.

Since 2011, Siri has helped customers via voice recognition and acted as a digital assistant. The user-friendly interface and capabilities resulted in broad client adoption, driving iPhone gross sales in the course of the preliminary launch interval. Exterior of Siri, Apple has made additional efforts to develop their AI providers, as they’ve purchased 21 AI startups for the reason that starting of 2017, which is greater than lots of their opponents.

Nonetheless, Apple’s present place is crucial. The aggressive Chinese language market has modified: in early 2024, analysis got here out exhibiting that Apple was promoting 24% much less iPhones in mainland China in comparison with this time final yr. This decline is a part of a lowering income pattern, with a possible for an excellent larger lower in direction of the tip of FY 2024 Q2 in China. The reasoning for this decline will be the notion amongst Chinese language customers that Apple’s AI choices fall quick to opponents. One in all Apple’s greatest opponents within the Chinese language market, Huawei, has seen gross sales develop by 64%. These native corporations present superior AI options, aggressive pricing, and providers particular to native preferences.

In essence, Apple must innovate. I feel their push into AI will do exactly that.

FY 2024 Q1 Report Supplies Clues

Throughout Apple’s FY 2024 Q1 report from February, buyers’ consideration was on their integration of synthetic intelligence (“AI”) throughout their product lineup. Apple’s latest launch of iOS 17 contains new options pushed by AI know-how. A few of these options embrace, Private Voice and Reside Voicemail, together with lifesaving purposes, comparable to fall detection, crash detection, and ECG monitoring on the Apple Watch.

As of this earnings report, Apple emphasised their present base of over 2.2 billion lively gadgets, possessing a strong basis for growth. For my part, most of those gadgets may finally be upgraded because of the AI catalyst (and the truth that AI will result in new options that make customers ). I speak extra about what I anticipate from the improve cycle within the valuation part, however I feel even when a small portion of this lively gadgets base upgrades the advantages might be immense for Apple’s earnings.

Retaining all of this in perspective, by the way in which, Apple isn’t at the moment in a tricky spot with their positioning within the international smartphone market. Apple truly had the prime spot for smartphone market share in 2023 globally (by model). They even overtook their arch rival Samsung by items offered. I feel this is a wonderful place to be going into a possible tremendous cycle improve.

AI In The iPhone Might be Huge

As talked about above, the combination and development of AI in Apple’s gadgets is a core focus of the corporate, considered one of these gadgets being the iPhone.

Such a know-how has the potential to make the iPhone a extra clever and proactive assistant via options comparable to seamless voice recognition, predictive textual content enter, sensible process automation, and context-aware solutions. Apple’s personal AI mannequin Ajax may enhance already carried out applied sciences comparable to Siri, by making it extra conversational and contextually conscious, much like ChatGPT. Different potential AI options may embrace auto-summarizing and auto-complete in core apps like Pages and Keynote. Reviews present that Apple can be engaged on a brand new model of Xcode and different improvement instruments that construct in AI for code completion, which might enhance the standard of third-party apps on the iPhone.

The developments of chatbots, customized app experiences, and improved {hardware} efficiency, are powered by deep studying algorithms. This know-how goals to realize extra intuitive and customized providers, tailor-made to particular person preferences and behaviors. Nonetheless, and I feel that is key for Apple, the know-how big can be reported to be leveraging LLMs made by opponents like Google, OpenAI or Baidu (BIDU) in China.

I feel this technique is genius. Apple is aware of that being a frontrunner within the LLM house is troublesome and requires a ton of infrastructure buildout. Very like how Google turned the default search supplier on Safari, I anticipate a LLM from considered one of these corporations to be the default LLM on gadgets within the US and Europe, and Baidu’s Ernie to be the default LLM in China.

That’s to not say that Apple themselves is giving up on AI. Like I stated, they’re nonetheless engaged on their very own mannequin, known as Ajax. This mannequin, nonetheless, will energy extra native, on gadget requests that don’t require an web connection.

The anticipated launch of those new AI fashions is suspected to come back on the Worldwide Builders Convention (WWDC) in June. To be able to preserve their competitiveness in opposition to tech rivals, Apple’s timeline for deploying new AI fashions like Ajax is supposedly aligning with the launch of upcoming iPhone iterations. This occasion is often when Apple unveils their upcoming working techniques and software program upgrades.

As of when I’m penning this piece, Apple simply introduced their WWDC convention for June tenth.

AI on the Mac might be big

The iPhone isn’t the one gadget receiving the combination of superior AI, the Mac could also be too. Apple has already been making important strides in integrating AI into their Mac gadgets. The brand new 13- and 15-inch MacBook Air, powered by the M3 chip, is at the moment named the “world’s finest client laptop computer for AI” and that is earlier than Apple makes any devoted AI {hardware} modifications. The M3 chip, constructed from industry-leading 3-nanometer know-how, has a sooner and extra environment friendly 16-core Neural Engine, together with the CPU and GPU having accelerators to enhance on-device machine studying. This makes the MacBook Air a wonderful platform for AI, providing power-efficient efficiency and portability.

Different corporations have begun integrating superior AI know-how into their gadgets, comparable to Microsoft’s AI initiatives in Home windows. Microsoft lately launched a brand new Copilot key to Home windows 11 PCs. This key, when pressed, invokes the Copilot in Home windows expertise, making it seamless to have interaction Copilot in day-to-day duties. Apple’s use of the same framework with an AI particular key may permit them to assemble the same mechanism.

The mixing of AI know-how is a major contributor to Apple’s future however in addition they could also be opening up alternatives to promote their very own AI applied sciences. Apple has been growing its personal generative AI for years. It’s anticipated that Apple will launch a brand new software program improvement instrument that can use generative synthetic intelligence to assist deliver automations coding work.

Future Outlook In China

The long run outlook for Apple, notably within the Chinese language market, closely depends on the anticipated AI enhancements in iOS 18. These rumored options purpose to revitalize iPhone gross sales, as Apple goals to develop its AI capabilities to recapture its recognition amidst the aggressive dynamics of China’s smartphone market.

To be able to counteract the present decline in gross sales and income shrinkage in China, Apple might want to enhance their funding in AI analysis and improvement. Localizing AI options, comparable to adapting Siri to align extra carefully with Chinese language tips for AI mannequin deployment. Baidu’s Ernie is considered one of 40 fashions authorised by the Chinese language authorities for public use.

Valuation

I feel to finest perceive the upside potential in Apple, it’s vital to grasp how they at the moment make cash.

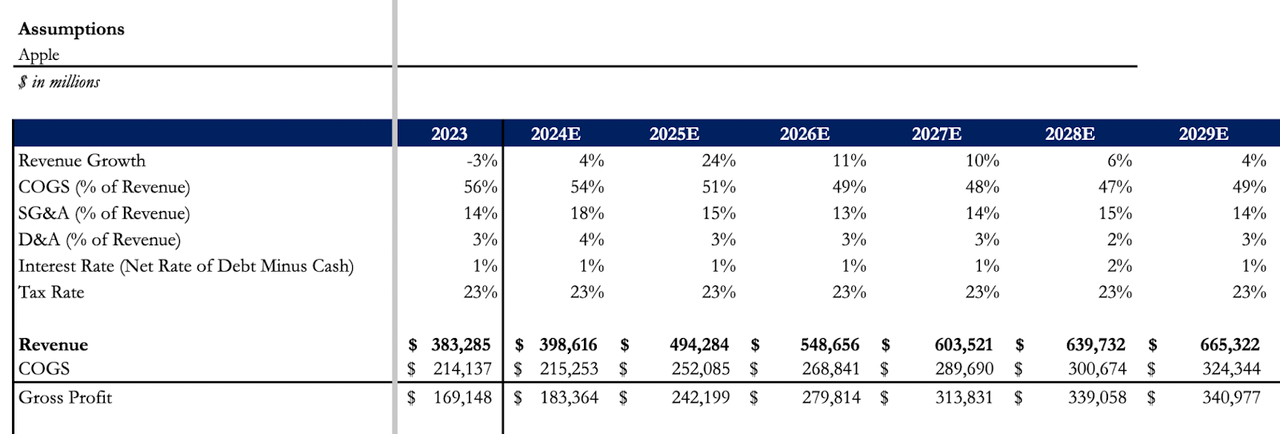

Apple made roughly 58% of their income from iPhone gross sales in the latest quarter (Apple 10Q). In my assumptions, I assume that this proportion stays the identical attributable to iPhone income rising, but in addition different revenues rising as properly.

When assessing Apple’s marketplace for superior AI gadgets, Financial institution of America analysts famous that they anticipate to see an iPhone improve cycle, fueled by the rising demand for generative AI options. Additionally it is vital to level out that in 2020 a major variety of iPhone customers have been already a part of the iPhone Improve Program. These numbers have possible grown since. Together with this, 51% of US Apple customers often improve to a brand new mannequin as quickly as their supplier permits it. Given these tendencies, I imagine it’s cheap to imagine {that a} important variety of customers could be involved in upgrading their iPhones to entry new AI options.

Based on one of many main know-how analysts on the road, Dan Ives, he estimates that Apple has 270 million iPhones in the improve cycle window attributable to new AI options and attributable to iPhone improve plans. In calendar yr 2023, Apple offered 235 million iPhones, which means this supercycle would have roughly 14.9% quantity progress in comparison with final yr.

In a earlier tremendous cycle across the iPhone 6, we noticed a leap to 231.2 million items offered from 169.2 million the earlier yr. This represented a 36.7% leap in volumes. I feel Dan Ives’ estimates (particularly as a result of the AI options are huge upgrades) are cheap at only a 14.9% quantity progress.

On prime of this, I imagine that the ASP (common promoting value) for the iPhone may go up this yr attributable to new options. For reference, the bottom mannequin iPhone within the present lineup goes for $799 within the US. Whereas that is a lot larger than the MSRP of the unique iPhone in 2007 (MSRP of $499), if you account for inflation that is $733 in 2024 {dollars}.

The baseline iPhone has solely elevated by $66 in actual phrases since 2007 regardless that the iPhone has extra options (ex. the App Retailer and duplicate/paste each weren’t a factor on the primary iPhone).

Earlier iPhone generations (such because the iPhone X) had a beginning value of $999. Whereas these have been accompanied by an iPhone 8 with a beginning value of $699, the iPhone 8 now has an inflation adjusted value of $869.

Given this, I feel we may see iPhone ASPs rise by $100 in nominal phrases this improve cycle given the brand new AI options.

The remainder of Apple I anticipate to develop at the same price, giving us a mixed income progress for FY 2025 (yr beginning 10/1/2024) of 24%. I anticipate Apple to have subsequently higher income progress from right here as customers profit from AI providers (analysts are forecasting these providers may have a month-to-month subscription charge connected to them like ChatGPT+) and new AI options on their MacBook lineup (seeing the same AI improve cycle like we’ll possible see with AI PCs). As well as, larger ASPs will assist profit income from customers who improve in later years (FY 2026-FY 2028).

Apple Income Estimates (Noah’s Arc)

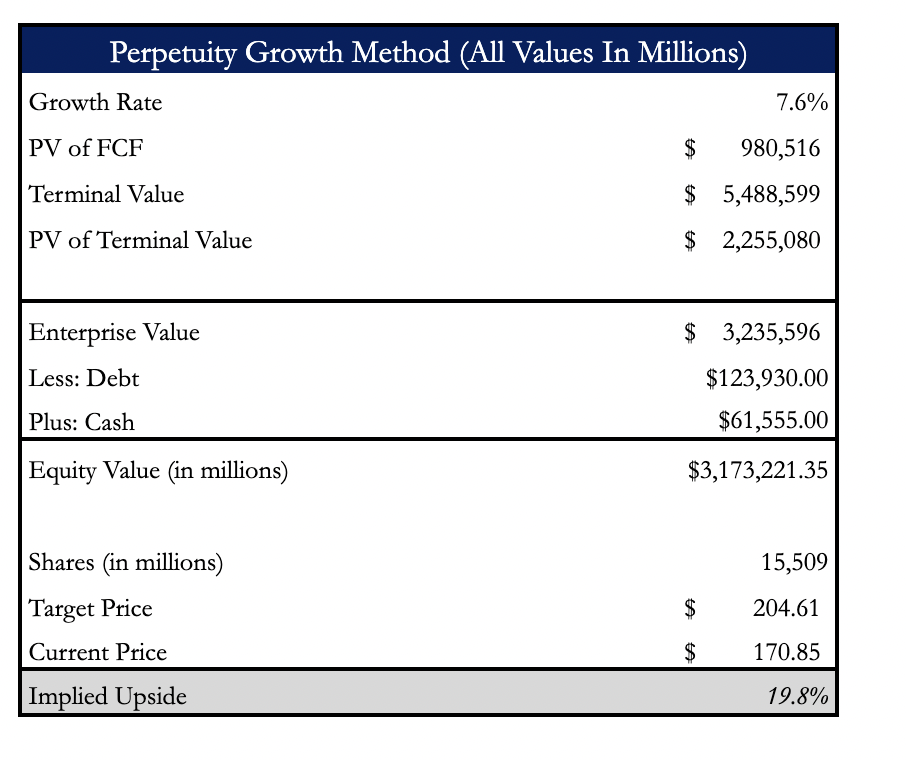

Given this, my mannequin is exhibiting that with a reduction price of 9.3%, Apple has a future PV of $204.61/share. This means fairness upside of about ~20% from the place Apple inventory was as of the time of this writing. This could even be an all time excessive.

Take into account that this assumption assumes no share buybacks (which Apple has been aggressively doing). I anticipate share buybacks to extend EPS and allow buyers to use a better P/E a number of to this (which may give a better share value from what the mannequin is saying).

Apple DCF Evaluation (Noah’s Arc)

The place This Matches In With My Earlier Apple Analysis

Final December, I wrote up a analysis arguing that Apple will profit immensely from new healthcare tendencies, which may unlock upside within the know-how big’s inventory. Whereas I proceed to imagine that Apple may have upside potential, I acknowledge that the corporate has extra headwinds now (China gross sales, DOJ lawsuit, European regulatory danger) that they didn’t have in December. I imagine that every one of those considerations will finally abate, however for now I wish to give a valuation that’s extra conservative, but presents extra routes for upside.

To be extra particular, final time I argued that Apple had upside in its shares attributable to what I believed to be a $100 billion alternative within the healthcare market. I utilized a value to gross sales a number of of 6 to this income to generate an upside potential of $600 billion in market cap from the place the corporate was in December.

Since then, the slowdown in gross sales in China has brought on the residual worth of Apple (not together with healthcare alternatives) to lower. As well as, the DOJ lawsuit within the US has opened up the danger that Apple might be pressured to permit extra opponents onto their platform of two.2 billion gadgets. Which means the income alternatives in healthcare to the corporate might be diminished as different healthcare centered corporations are actually capable of leverage the Apple ecosystem higher.

In essence, this has made me decrease my value goal to roughly $204/share from $237.70/share beforehand. That being stated, if Apple nonetheless reaches $237.70/share I might not be shocked, however I now view $204/share as a way more achievable and real looking value goal given the place the corporate is as we speak.

Danger to Thesis

Though Apple at the moment has a strong place within the tech panorama, they nonetheless face dangers that might doubtlessly influence this place, particularly within the Chinese language market. As I discussed earlier than, Apple has seen a decline in gross sales, with a drop of 24% within the first six weeks of 2024, and appears possible brought on by native competitors from manufacturers, comparable to Huawei, Vivo, and Xiaomi.

On prime of this, latest lawsuits by the DOJ within the US, and new enforcement actions by the EU nonetheless loom massive. Whereas each enforcement actions are worrisome, I truly suppose Apple’s AI technique will assist combat these, particularly within the US.

For instance, one of many greatest complaints within the DOJ lawsuit is that Apple has been utilizing their platform to hinder apps from being profitable on their platform. A part of this has been the 30% app retailer charge Apple is charging for apps to listing on the app retailer.

Current proposed partnerships with Google, OpenAI, and even Baidu may also help offset this. It may well present how Apple is prepared to usher in outdoors main tech gamers and permit them to work together with the iOS ecosystem in a manner that was beforehand simply reserved for Siri or Apple authorised providers, which have been topic to the 30% income lower. All of the whereas, it permits Apple to get finest in school LLMs built-in of their {hardware} simply in time for the most recent improve cycle.

On prime of this, one of many main points in China has been that the federal government has banned the usage of Apple iPhones for presidency workers on nationwide safety considerations. Integrating a mainland China supplier like Baidu into their working system to deal with AI-based queries is a good way to assist mitigate this concern. Notably, Apple CEO Tim Prepare dinner went to Shanghai final week to assist shore up the know-how giants relationship in China. A part of this journey, it seems, have been discussions with Baidu.

On this particular case, Apple analyst (with a strong monitor report) Gene Munster offers this Baidu deal a 75% likelihood of closing. I’m optimistic as properly and suppose this can be a nice danger mitigation technique. Within the US, the adoption of an LLM from both OpenAI or Google may permit Apple to thwart a few of the considerations of the DOJ lawsuit by exhibiting how they will welcome outdoors corporations into what many have described as a “walled backyard.”

How I Will Be Monitoring My Thesis

Very like with my healthcare analysis I revealed in December, I will be watching how Apple offers with regulatory actions out of the US and EU. As well as, I shall be watching reviews on how their LLM integrations into iOS 18 are going since I see this as key to the improve cycle going into the possible new iPhone launch within the fall. I anticipate over the subsequent few months (and in the course of the subsequent earnings name) for the iPhone maker to be discussing increasingly more on their calls on what the AI expectations ought to be for Wall Avenue and Buyers.

As at all times, the perfect supply in the long term shall be Apple themselves. Nonetheless, since they’re so quiet on their actions, I have a tendency to observe analysts like Gene Munster and Dan Ives for earlier cues to assist perceive the place the corporate goes and get an edge.

Backside Line

Apple is likely one of the main figures worldwide within the tech {industry}, however the challenges within the aggressive Chinese language market and up to date regulatory actions within the US and Europe showcase how the panorama is altering. Regardless of these setbacks, I imagine Apple’s dedication to innovation, particularly via the combination of companions’ AI throughout their product lineup, will quickly reverse these struggles. Combining the event of outdoor LLMs together with hints in direction of the deliberate upgrades round iOS 18 present that Apple goals to not solely to carry their market share but in addition redefine person experiences. I imagine the corporate has a wonderful trajectory forward of them and up to date regulatory challenges and a slowdown in China is simply noise. I feel the inventory is a robust purchase.