AmCoastal extends reinsurance tower to $1.2bn because of new cat bond: CEO – Cyber Tech

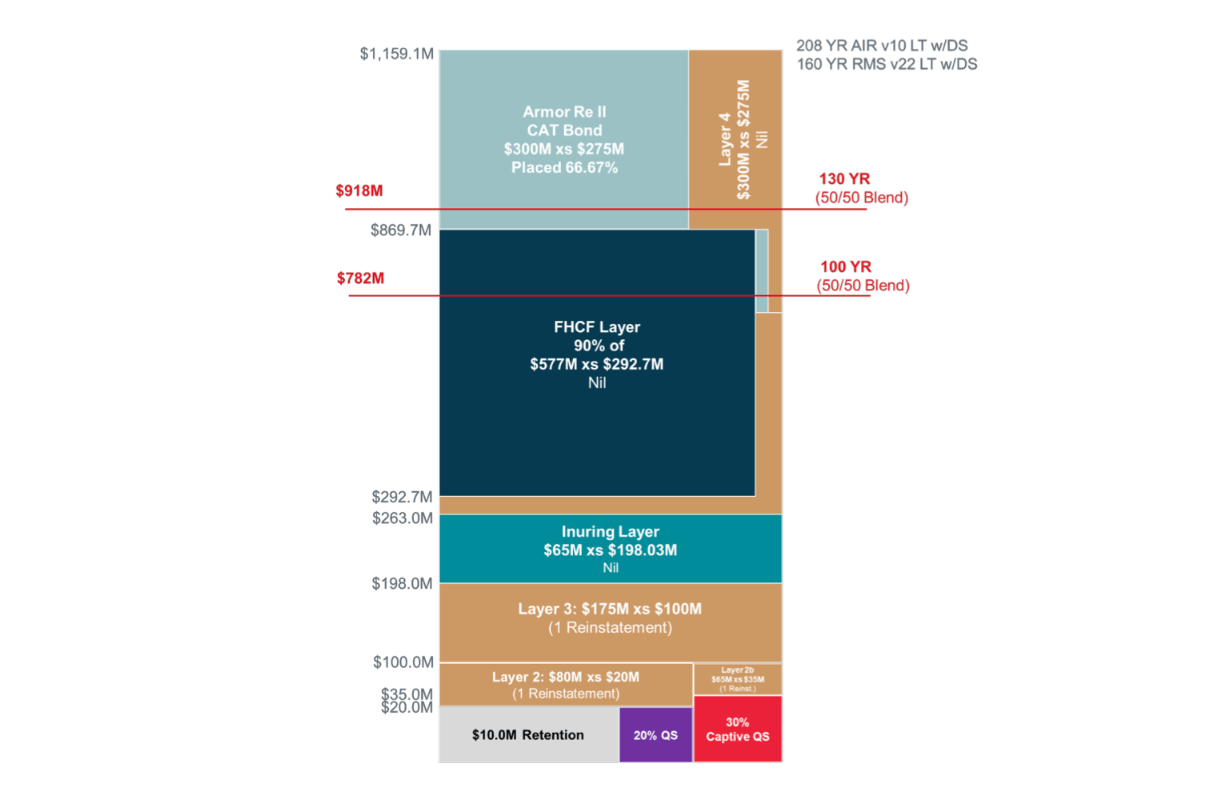

Because of the current profitable issuance of its newest disaster bond, American Coastal Insurance coverage (AmCoastal) has prolonged the highest exhaustion level of its major disaster reinsurance tower to roughly $1.2 billion for 2024, in accordance with CEO Dan Peed.

As Artemis had reported, AmCoastal efficiently secured an upsized $200 million Armor Re II Ltd. (Collection 2024-1) Florida named storm cat bond in April, finalising the take care of a threat unfold inside the lower-half of the preliminary vary of worth steerage.

The insurer has now disclosed that the disaster bond occupies roughly two-thirds of the top-layer of the principle AmCoastal disaster reinsurance tower for 2024.

In the course of the insurer’s earnings name yesterday, CEO Dan Peed commented on the reinsurance renewal saying, “Now we have elevated our multi-year reinsurance commitments, enhancing stability. Our 2024 disaster reinsurance program was marketed with a construction that additional protects the stability sheet.”

Including that, “Now we have been in a position to improve the anticipated exhaustion level with the profitable placement of AmCoastal’s multi-year cat bond which was oversubscribed on the decrease finish of the anticipated coupon vary.”

AmCoastal President Brad Martz went into extra element on the reinsurance tower renewal, explaining, “As of immediately, we have now secured over 90% of the whole restrict being sought, and the position is progressing in keeping with our expectations.”

He stated that AmCoastal had three targets when it started planning its reinsurance renewal for the 2024 hurricane season, to extend the general safety, enhance value effectivity, and preserve related ranges of retention.

“I consider we are going to obtain all three this 12 months,” Martz stated.

“For American Coastal, we’re searching for to buy roughly $265 million extra restrict from the non-public market this 12 months, which can stretch our exhaustion level up nearer to $1.2 billion, for the 208-year return time in comparison with the expiring program of 167-year return time as estimated by the AIR hurricane mannequin.

“$200 of the extra open market restrict was secured in a brand new three-year disaster bond that closed in April,” he commented.

Martz additionally famous that AmCoastal’s quota share reinsurance is being diminished from 40% to twenty%, which ought to drive “a cloth improve in web premiums earned, partially offset by increased web losses, as we retain extra of these.”

The objective with the brand new reinsurance technique is to “retain extra of our gross underwriting margin,” Martz stated.

He added that, “We count on to have each towers fully-placed properly earlier than June 1st and we are going to present extra info on the ultimate limits, retentions, and prices, as soon as each packages have been accomplished.”

You’ll be able to see the brand new AmCoastal 2024 reinsurance tower under.

You’ll be able to learn all about AmCoastal’s new Armor Re II Ltd. (Collection 2024-1) disaster bond transaction and each different cat bond ever issued in our Artemis Deal Listing.