I wager you are not dismissing challenger banks now – Cyber Tech

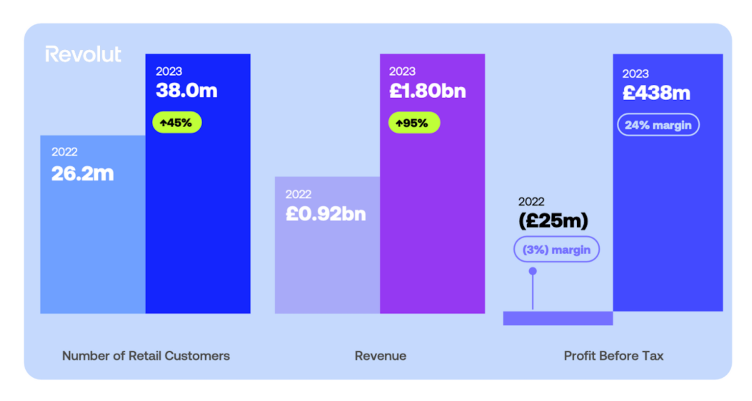

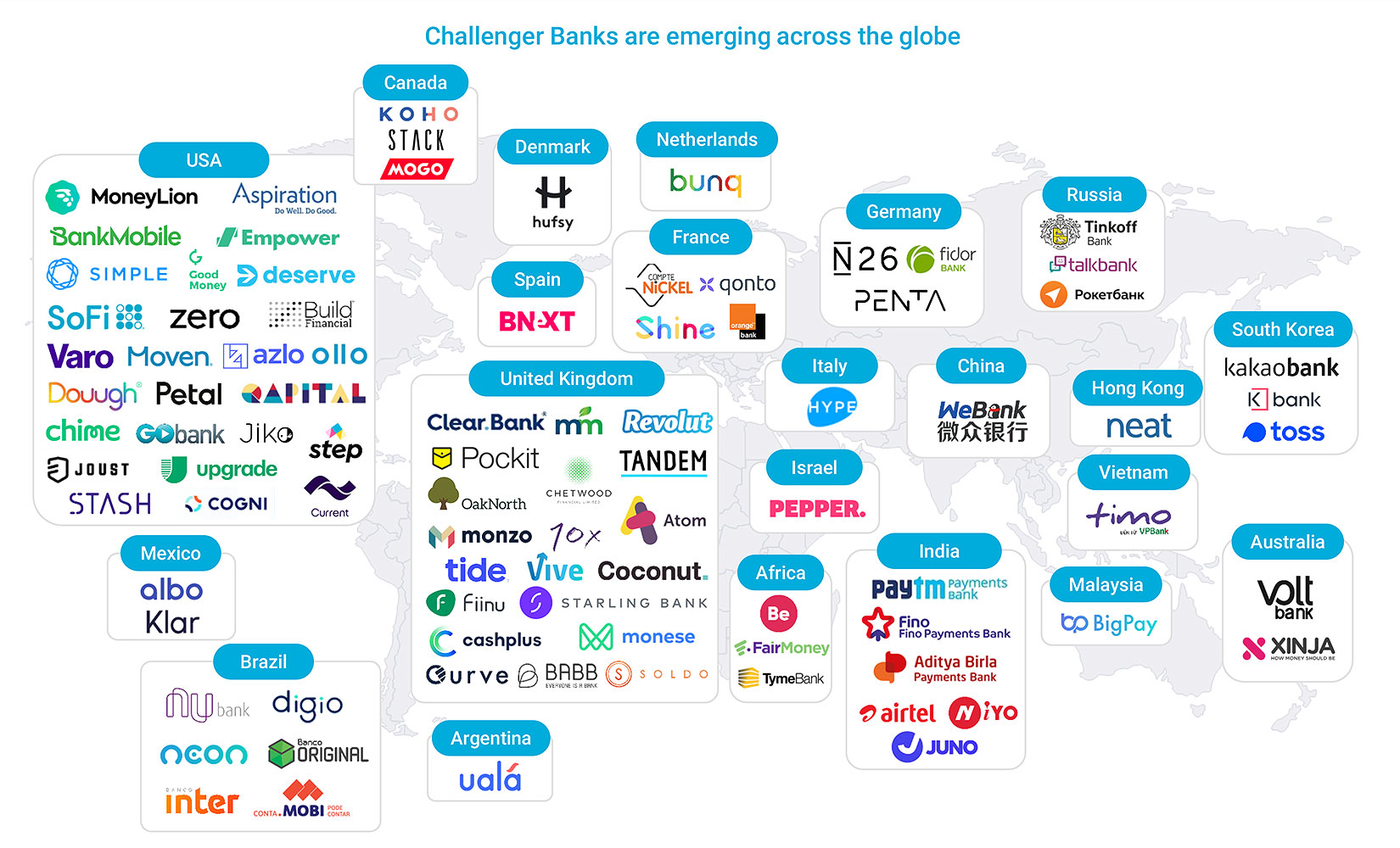

I keep in mind ten years in the past when fintech was rising from below the hood and challenger banks grow to be a brand new phrase. Many of the bankers I spoke to again then mentioned they might by no means be actually difficult. Ten years later, the scenario is slightly completely different. Revolut has over 40 million prospects and is worthwhile; Monzo has 10 million prospects and is worthwhile; Starling, with extra concentrate on SMEs, has 4 million prospects – of which half one million are small companies – and is worthwhile … want I’m going on?

Supply: Marcel van Oost

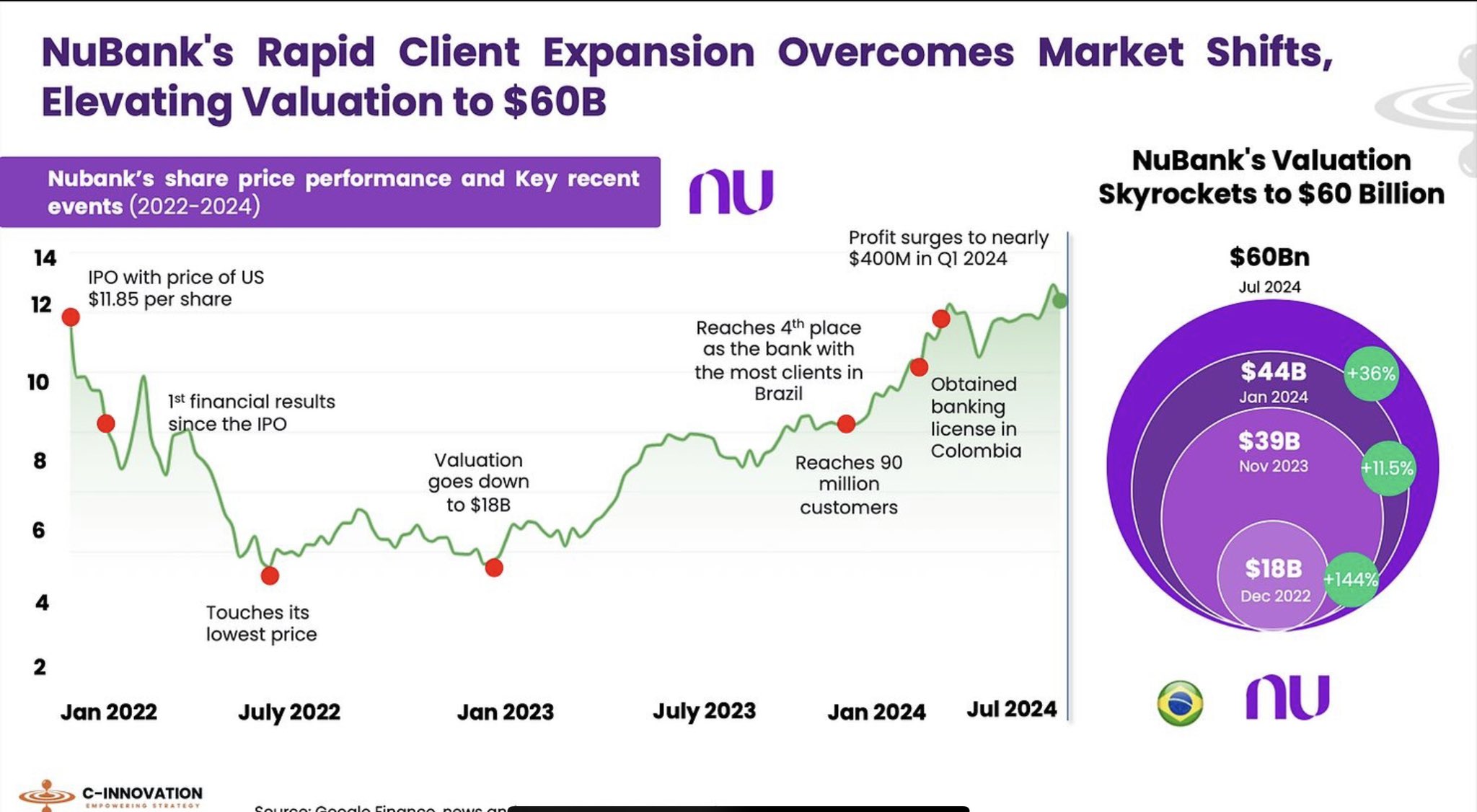

The standout needs to be NuBank in Brazil, whose valuation has simply exceeded $60 billion and has seen wonderful development.

Supply: Marcel van Oost

In fact, some have failed and a few have been acquired, however it’s wonderful how vibrant the sector has grow to be.

Supply: Aerospike

Why are they succeeding? Nicely, for pretty apparent causes:

- Innovation: Challenger banks typically use expertise to supply a extra seamless and handy banking expertise, resembling mobile-only banking apps and digital-only accounts.

- Quicker Signal Up – Many challenger banks concentrate on the quickest onboarding course of doable, even issuing digital playing cards that can be utilized to make funds earlier than the actual one arrives.

- Charges – Challenger banks might have decrease charges than conventional banks.

- Customer support: Challenger banks typically have a extra direct and private method to customer support, and lots of provide prolonged hours of help via digital channels.

- Area of interest providers: Some challenger banks concentrate on particular market segments or niches, resembling poor credit score or small companies, and should provide specialised services tailor-made to these teams.

- On-line banking expertise: Challenger banks focus extra on the net banking expertise, making it simpler and extra environment friendly for purchasers.

Supply: Enterprise Knowledgeable

However you must realise that conventional banks will not be ignoring the challengers. In reality most conventional banks are hiring engineers and builders from the challenger banks, and getting them to develop related functionalities on their apps and methods. The market is scorching.

One of many details I make nevertheless, is that challenger banks are thriving as transactional banks coping with day-to-day transactions, however most will not be gaining property and loans at scale in the identical means as conventional banks. Equally, most challenger banks are targeted upon client banking, when the actual cash is made in industrial and funding banking.

So, what’s the longer term (WTF?).

The longer term is one the place challenger banks have succeeded in difficult sure areas of conventional banking however, the extra inroads they make, the extra possible they are going to be focused. Consider a challenger financial institution with an enormous bullseye on their financial institution that the massive banks try to shoot.

The longer term goes to be one the place extra challengers will probably be acquired, focused, imitated and failed. Having mentioned that, the longer term is one the place some challengers will proceed to breakthrough, develop, thrive and succeed. On the latter, you must surprise who you’ll wager on. Personally, I might say those which can be doing effectively at the moment – Chime, Bunq, NuBank and others – will not be going to go away. They may proceed to develop and problem.